The Ministry of Economy and Finance of Cambodia has issued Prakas No. 346 mandating the implementation of Capital Gains Tax (CGT) for all taxpayers which will become effective from January 2024 onward. This will ensure that they will pay a 20% levy on all profit earned from selling a capital asset. All taxpayers—whether you’re a resident, legal entity, or more—are obligated to pay this tax if they sell a capital asset like real estate property in Cambodia, financial assets, intellectual properties and more.

While paying for capital gains isn’t new to residents, this policy strictly falls on individuals and legal entities’ assets. This is unlike before where businesses were the only ones required to pay capital gains.

Moreover, if you’re currently deciding to sell an asset or you want to compute the tax, there are two ways to calculate it using the following:

- Actual expenses deduction method → Using this method, you need to first make a comprehensive and accurate list of all the expenses for the asset that you can deduct. If it’s a real estate property, renovation costs, loan, registration or transfer taxes, and more can be included in the deductibles. Once you’ve added all of the expenses to the original price of the asset, you need to subtract the actual expenses to the sales price. Only when you have the difference can you multiply it to 20% to gain the capital gains tax you need to pay.

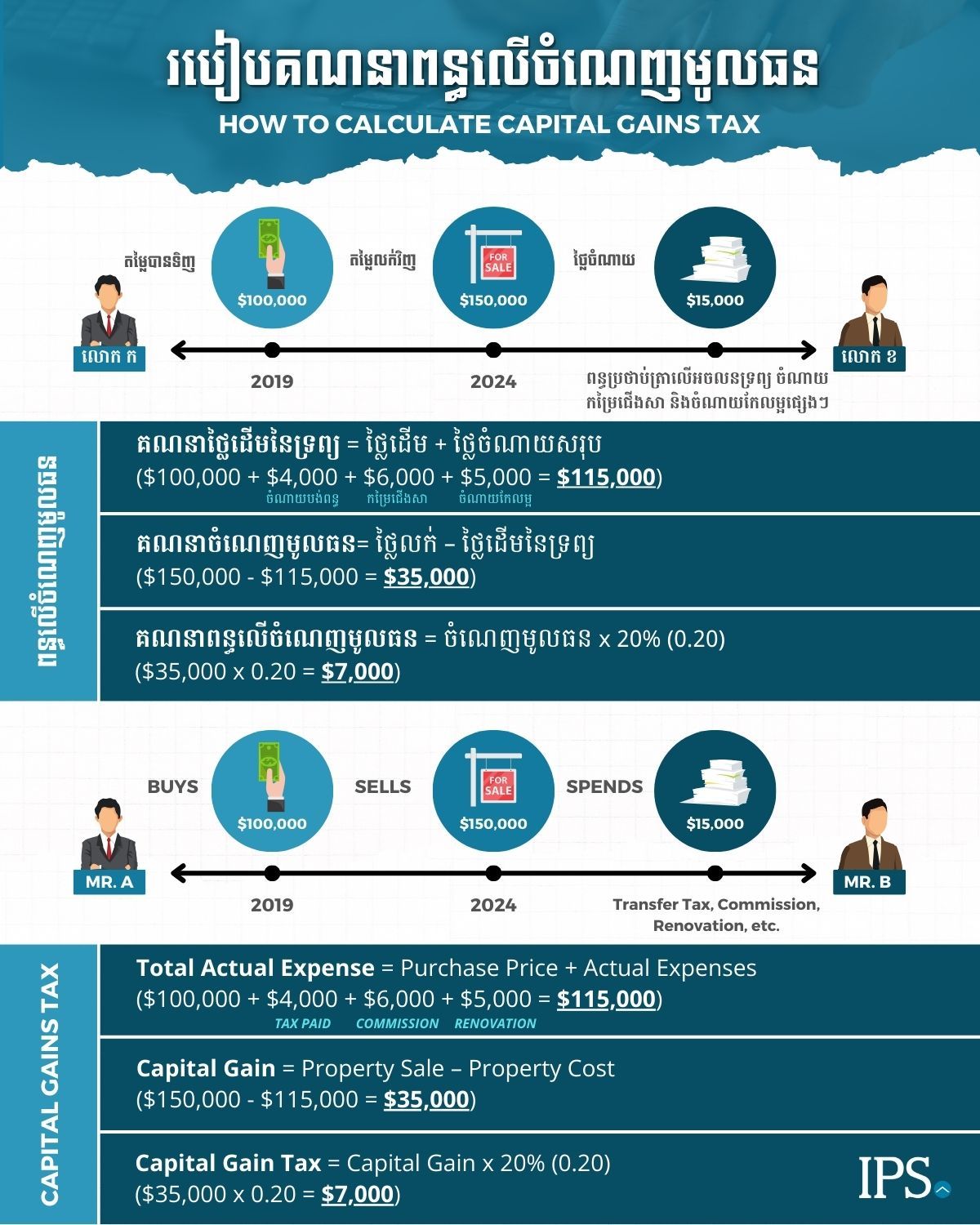

The General Department of Taxation (GDT) has issued a sample computation demonstrating the formulas used to calculate (20%) capital gains tax.

SAMPLE COMPUTATION (REAL ESTATE)

Mr. A sold his house to Mr. B for $150,000, which he had originally purchased for $100,000. In addition to the sale, Mr. A paid $4,000 for transfer tax, $6,000 as commission for selling the house, and $5,000 for renovation. He kept all the relevant expenses documents.

The formula you need here is:

- Total Actual Expense = Purchase price + Tax paid + Commission + Renovation cost

= $100,000 + $4,000 + $6,000 + $5,000

= $115,000

- Capital Gains = Property Sale – Total Actual Expense

= $150,000 – $115,000

= $35,000

- Capital Gain Tax = Capital Gain x 20% (0.20)

= $35,000 x 0.20

= $7,000

- Determination-based expense deduction method → Using this method, you need to subtract 80% of the capital asset’s sales price from its full value. Once you have the number, you need to compute the 20% capital gains tax from it.

In short, the computation is:

(Sales price – 80% of sales price) * 20% = CGT

For example, if you’re selling a property for $300,000 and you want to compute the capital gains tax from it, here is a sample computation:

- Sales price: $300,000

- 80% of sales price: $240,000

- ($300,000 – $240,000 = $60,000) * 0.20 = $12,000 CGT

DEEP DIVE: ស្វែងយល់ស៊ីជម្រៅអំពីពន្ធអចលនទ្រព្យកម្ពុជា