Right value pricing refers to setting a price that accurately reflects the value of a property, taking into account the factors that affect property value such as location, property condition, market demand, and comparable properties in the area.

On the other hand, over and under value pricing occurs when a product, property, or service is priced too high or too low, respectively, leading to missed opportunities and potential losses.

Understanding the differences between right value, over value, and under value pricing is essential for developing an effective pricing strategy that appeals to your target audience and helps you achieve your financial goals.

Right Value Pricing

Right value pricing refers to setting a price that accurately reflects the value of your property in the Cambodian real estate market. To determine the right and accurate value for a property, an expert property valuer is usually needed.

Property valuers have a particular approach and study that helps them get an accurate value for a property. A professional valuer can also give advice on other factors such as financing options and mortgage rates, and whether or not the property investment makes sense for your financial goals. The data gathered and the final value are submitted through a comprehensive report that will give you an accurate picture of how much your home is worth today.

To understand the valuation process, here are some of the main steps to determine the right value for your property in Cambodia:

- Client Instructions: 85% of IPS’s clients are banks requiring objective valuations for mortgage and loan approvals. The remaining clients are property owners seeking their property’s worth and improvement suggestions.

- Document Submission: Clients provide necessary documents to confirm property ownership and details, including titles, ID cards, construction costs, permits, and business-related documents.

- Inspection Arrangement: A physical site inspection and authority check are conducted to assess factors impacting the property’s market value.

- Market Value Analysis: An in-depth analysis of the property’s market value is performed, considering all relevant factors.

- Report Preparation: Three reports are created, including an Executive Report, Valuation Summary Report, and Valuation Certificate.

- Report Review: The Valuation Manager and Head of Valuation review the completed reports for accuracy and completeness.

- Report Delivery: The final reports are submitted to the requesting party or bank for use in mortgage or loan approvals, property divisions, and other purposes.

Over and Under Value Pricing

Over and under value pricing refers to setting a price that is either too high or too low for your product, property, or service in the Cambodian market.

Overvalued pricing occurs when the price exceeds the perceived value of the property, making it less appealing to potential buyers.

On the contrary, undervalued pricing happens when the price is set excessively low, potentially leading to the undervaluation of your product, property, or service.

Common mistakes in pricing

- Lack of market research: Failing to conduct thorough market research can lead to poor pricing decisions as businesses may not fully understand the preferences and purchasing power of Cambodian investors.

- Ignoring competitors: Neglecting to analyze competitor pricing strategies can result in setting prices that are either too high or too low compared to similar products, properties, or services in the Cambodian market.

- Inaccurate cost calculations: Underestimating or overlooking operational costs can lead to undervalued pricing, which can negatively impact profitability.

- Fixed pricing mindset: Failing to regularly review and adjust prices based on market trends and buyers’ feedback can result in over or under value pricing as businesses may not adapt to the changing market dynamics.

- Overemphasis on discounts and promotions: Relying too heavily on discounts and promotions can lead to undervalued pricing, as investors may perceive the discounted price as the true value of the product, property, or service.

Impact of Price on Visibility

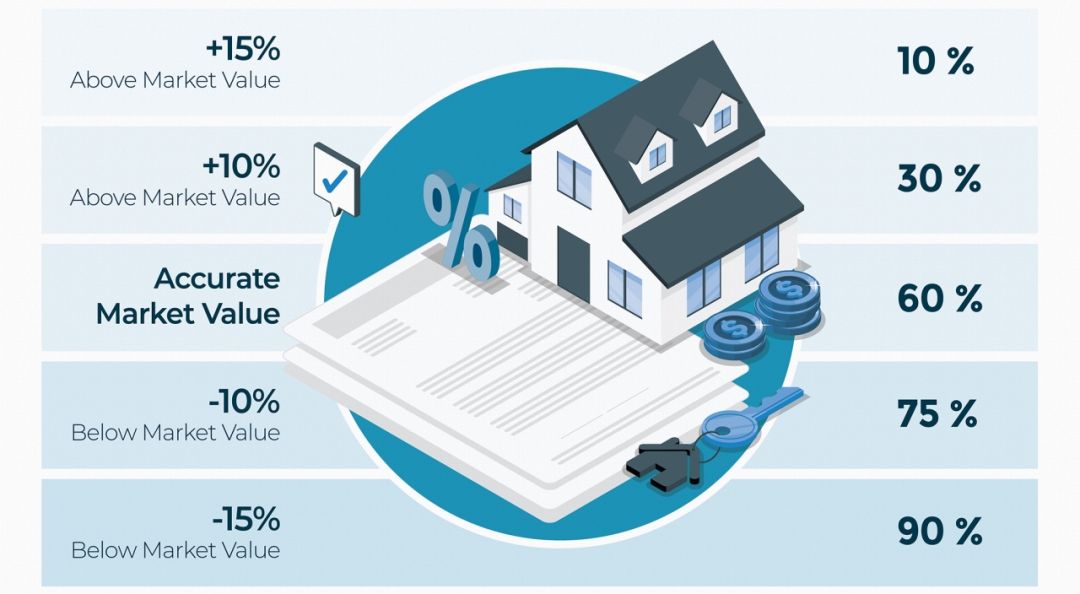

Investors often use price as a primary factor when making purchasing decisions, and businesses must carefully consider their pricing strategies to ensure they remain competitive and visible to their target audience.

A well-thought-out pricing strategy can capture the attention of the target audience and increase visibility.

In competitive markets like Cambodia, setting the right price is critical for a property’s success and perceived value among buyers. Striking the right balance between affordability and perceived value ensures offerings remain visible and attractive to the target audience.

Conclusion

A well-balanced pricing strategy not only appeals to the target audience but also maximizes profitability and shapes brand perception. Considering factors such as costs, competitors, and buyer preferences allows businesses to set prices that effectively capture potential buyers’ attention and convey their offerings’ value. By learning these strategies and continuously reviewing your pricing approach, you can significantly increase your property’s visibility and attractiveness.

Want to know the right value for your property? Our valuation team yields highly accurate results based on credible data from trusted local sources, comparable market analysis, and thorough property inspection. Contact us for inquiries!