In a market that lacks transparency, an impartial and properly researched property valuation is an important source of information for residential and commercial property owners, banks, and investors. Unfortunately, the valuation process can often take a back seat in the sale process or can be clouded by the ‘opinions’ of interested parties. At its heart, a property valuation is an opinion. Most real estate agents will be able to offer you an opinion of the market value of a property in Cambodia, however, it is the processes and the research underlying a property valuation, which will determine its importance.

So why does property valuation take a back seat in the sale process?

Property ownership in Cambodia has a relatively short history compared to the global norm. For many property owners in Cambodia, the sale of a property is often not a commercial decision, but often one based on necessity or opportunism. There is also an inherent lack of trust in companies and institutions; especially those claiming to wield the truth. Read also: New Commercial Office Spaces And How To Choose Your Next Office

Why is valuation Important?

Every property owner has an opinion of what their property is worth and every buyer has their own opinion. In markets that lack transparency or there is an in-balance of information, this creates inefficient markets where the variance in pricing of properties with similar characteristics is very large. Initially, this will create plenty of opportunities and risks for both buyers and sellers. In the long run, however, this dramatically reduces market liquidity. Sellers react by pricing well above what we think is fair and buyers offer well below the market value – so you have a stale mate. At IPS, we see valuation as a process to remedy this stalemate and improve transparency so that there are better outcomes for all market participants. Related: Top Mistakes First-Time Home Sellers Make

How do you reach a valuation?

There are a number of ways to value a property. If you talk to three different valuers regarding the value of a house, you will get three different values. At IPS, we use a number of different methodologies in measuring the value of a property, then we choose the right method(s) that suit that particular asset or an average of two or more methodologies. It is not only the methodology that is important, but the assumptions used to come to a valuation. These assumptions are crucially important in producing a fair and impartial valuation, and are built up over many years of experience working in the sales process and collecting data.

How do you use the data to come to a valuation?

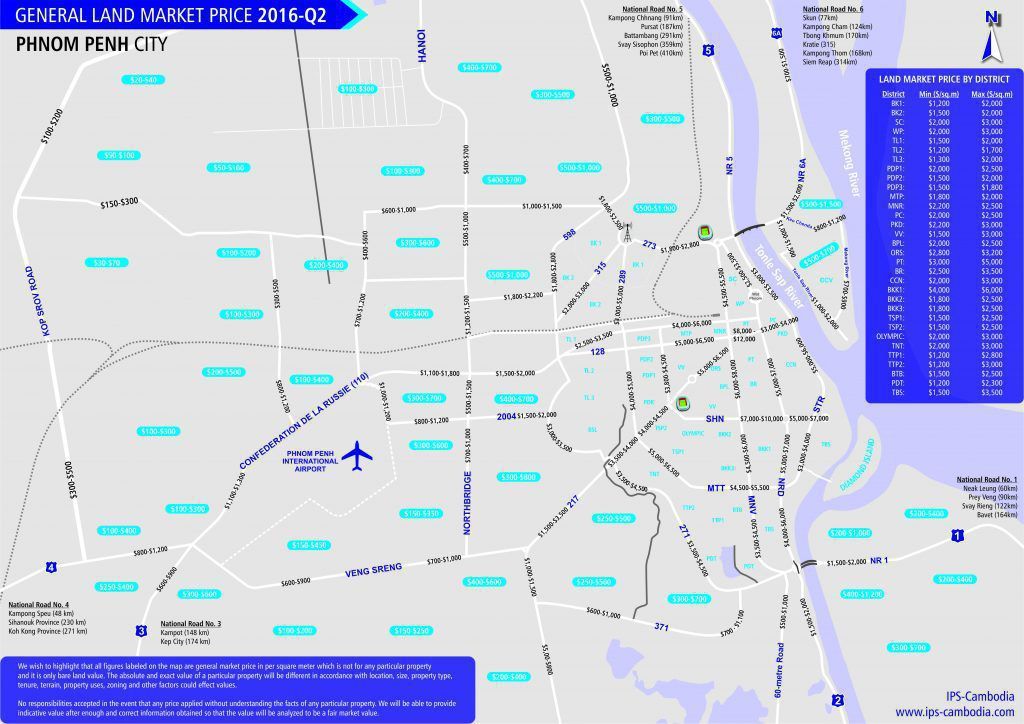

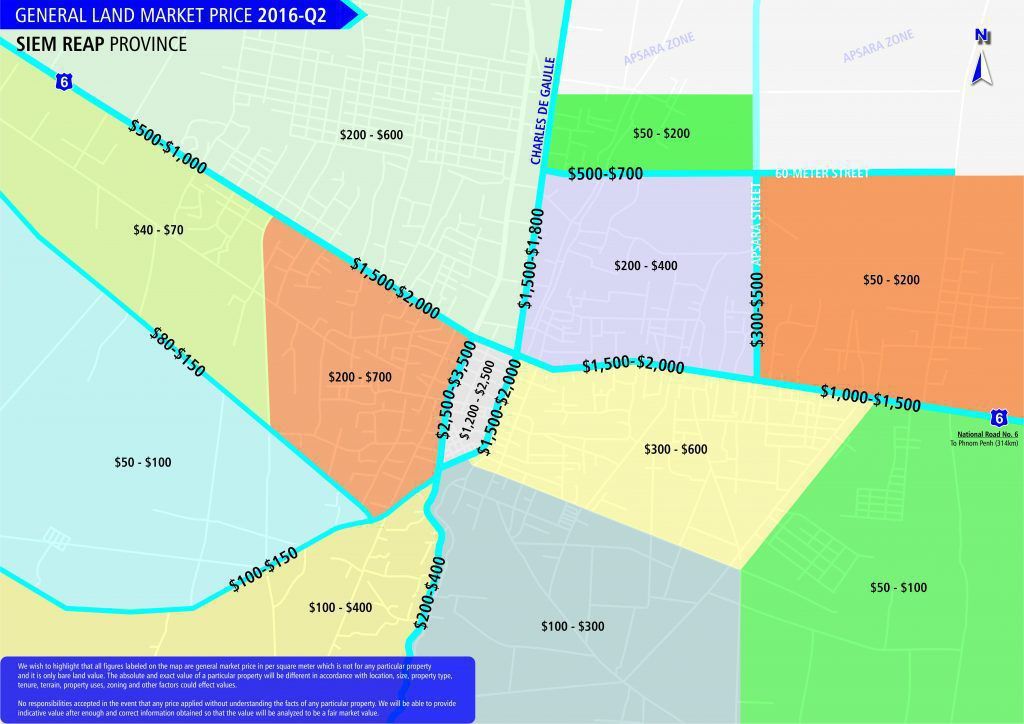

For the opinion to hold any weight it must be couched in reality. At IPS, we pride ourselves on having up-to-date and comprehensive price data for Phnom Penh and Siem Reap. Data that has been compiled by IPS’s head of Valuations, Sovannaroth Khan, and Valuations manager, Cheavly Leang, over a combined fifteen years. From this data, IPS’s valuation team draw their valuation assumptions and use their wealth of experience to create their perception of reality – a valuation. A valuation respected and approved by twelve of the leading banks in Cambodia.

For ease of understanding, we are proud to present the general land market price in two main areas where our offices located; Capital City of Phnom Penh and Siem Reap City. It’s also important to note that these maps are based on our own research and data collection.