The industry of real estate in Cambodia has been expanding rapidly, offering various opportunities for those looking to invest. This is why it is critical for investors to understand the different types of real estate investments in Cambodia to make informed decisions and maximize their returns. Each investment type has its own unique advantages, risks, and potential for returns.

By exploring these options, investors can identify the most suitable opportunities for their financial goals and risk tolerance. Let’s start with the most common ways to invest in real estate.

- Rental

Rental real estate is one of the most popular forms of investing in real estate, and for good reason. You can invest in houses, condos and apartments in Cambodia, rent them out to tenants or tenants-to-be either for long-term or short-term rental, and then collect the monthly income from the tenants through their rent.

- Resale

Resale real estate is another popular form of investment in real estate. It’s basically buying a home and selling it for more than you paid for it—so you make a profit on the transaction. The goal is to buy low, sell high, and repeat. Of course, this isn’t always possible—and there are risks involved in buying and selling any property. But if done correctly, resale investing can be very profitable indeed.

- Development Project

Development real estate refers to building new properties and flipping them for profit—usually by adding value via renovations or remodeling (but sometimes just by increasing land value). This type of real estate investment is riskier than other types because it involves more work up front; however, if done right, development can generate huge profits quickly.

These various ways to invest can be done in the different segments of the real estate sector namely residential, commercial, industrial, and agricultural.

Residential Real Estate Investments

A. Condominiums and Apartments

As urbanization continues to drive the demand for housing in cities like Phnom Penh and Siem Reap, condominiums and apartments have emerged as attractive options for both local and foreign investors. The rising demand for modern and convenient living spaces in urban areas has led to the development of high-quality residential projects, offering investors the opportunity to capitalize on the strong rental market and generate steady rental income.

B. Single-family Homes

These properties have experienced steady growth in suburban areas as more Cambodians aspire to own their homes. Single-family homes provide long-term investment opportunities, as they tend to appreciate in value over time. Additionally, they offer a sense of stability and security for families, making them a preferred choice for those looking to build family, settle down and raise their children in a comfortable environment.

C. Borey Developments (Gated communities)

As the middle class grows and more foreigners choose to invest in Cambodia, the demand for Borey communities for a secure and private living plus modern amenities has increased. Housing developments and gated communities provide a sense of safety and comfort, along with shared amenities such as parks, pools, and fitness centers. These properties are appealing to both local and foreign investors, who see the value in investing in communities that offer an enhanced quality of life for residents.

Learn more about the residential properties in Cambodia

Commercial Real Estate Investments

A. Office spaces

With the continuous business expansion in the country, there is a growing demand for office spaces, especially in major cities such as Phnom Penh and Siem Reap. This demand is driven by the increasing number of local and international companies setting up operations in Cambodia, which has led to a surge in the need for modern, well-equipped office spaces. Investors can benefit from this high demand by investing in office buildings and business centers that cater to the evolving needs of businesses in the region.

B. Retail properties

Shopping centers, malls, independent shops, and storefronts play an essential role in the country’s thriving retail sector. As consumers’ purchasing power increases, there is a growing demand for a diverse range of retail options. This has led to the development of various retail properties, from large-scale shopping centers to small independent shops.

Based on the retail report of The Mall Company (TMC), the total supply of existing retail in Phnom Penh at the end of 2022 was 716,253 sqm net leasable area (NLA), which is equivalent to a 53 percent increase over the 12 months; the highest rate of growth in retail ever recorded in Cambodia.

Investors can take advantage of this stock by investing in retail properties that cater to specific consumer preferences and provide an attractive shopping experience.

C. Hotels and hospitality

The growth of tourism in Cambodia remains robust especially as the globe is entering the post-Covid era. This has led to a rise in demand for accommodation options, ranging from boutique hotels and resorts to budget-friendly guesthouses.

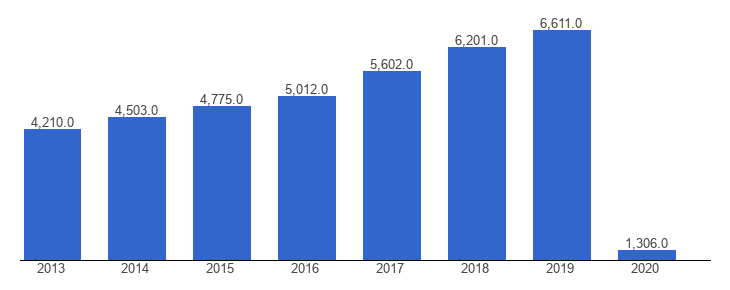

According to the forecast of Asian Development Outlook (ADO) released on April 2023, the tourism sector of the Kingdom is expected to reach 7.3% growth rate. Meanwhile, the tourist arrivals in Cambodia has been consistently over 4M tourists annually during pre-Covid times.

The Kingdom hopes to reach 4M tourists by the end of 2023, exceeding the previous year (2023) where Cambodia welcomed 2.28 million visitors. Assuming that there will no longer be travel restrictions and health concerns globally in the next three years, the tourist arrival rate in the Kingdom is expected to return to pre-Covid levels in 2026 or 2027.

This presents an opportunity for investors to capitalize on the thriving tourism market while contributing to the development of Cambodia’s hospitality sector. By investing in hotels and hospitality properties that offer unique experiences and cater to various traveler preferences, investors can benefit from the sustained growth of the tourism industry in Cambodia.

Learn more about investing in commercial real estate in Cambodia

Land Investments

A. Agricultural land

With a strong agricultural sector that includes rice production and rubber plantations, Cambodia offers numerous opportunities for investors interested in agricultural land. Additionally, as the demand for organic and sustainably produced food increases, there is significant potential for investors to venture into organic farming.

B. Industrial land

As the country continues to develop its manufacturing and logistics capabilities, industrial land has become increasingly valuable. This is evident through the establishment of manufacturing hubs and special economic zones, which offer tax incentives and other benefits for businesses operating within their boundaries.

Investors can capitalize on this growing trend by investing in industrial land, ensuring that they are well-positioned to benefit from the expansion of Cambodia’s manufacturing and logistics sectors.

C. Development land

How can investors benefit from investing in development land in Cambodia? As urban expansion and infrastructure projects continue to reshape the country’s landscape, development land offers long-term appreciation potential.

Learn more about investing in agricultural real estate in Cambodia

Other Types of Real Estate Investments

Real Estate Investment Trusts (REITs)

As an indirect investment option, REITs offer a way for investors to gain exposure to real estate without the need for direct property ownership. This allows for easier diversification and risk management, as investors can access a wide range of properties through a single investment.

REITs provide the opportunity for investors to benefit from the growth of Cambodia’s real estate market while minimizing some of the risks associated with direct property ownership.

Mixed-use properties

These properties combine residential, commercial, and retail spaces within a single development, maximizing the potential for returns on investment. By offering a variety of spaces catering to different needs, mixed-use properties can attract a diverse range of tenants, increasing rental income and property value.

Investors who choose to invest in mixed-use properties can benefit from the synergies created through the combination of different property types, positioning themselves to capitalize on the growing demand for versatile and multi-functional spaces in Cambodia.

Conclusion

Cambodia’s real estate market presents various investment opportunities. However, investors must exercise due diligence and seek local expertise to navigate the market effectively. Grasping local regulations, trends, and potential risks is crucial for informed decision-making.

By partnering with a knowledgeable and reliable partner like IPS Cambodia, investors can confidently navigate the Cambodian real estate landscape and make well-informed investment choices.