Once you start working and saving, one of the biggest decisions you can make is what will you invest in first: your first home or a car? Investing in both is a good idea but generally not at the same time since they are not inexpensive.

Buying a Car VS. Buying a House

Currently, Cambodia has no manufacturing facilities for any cars or car parts. Thus, all cars are imported and are subject to over 100% taxes, which make cars more expensive in Cambodia than in the United States.

On the other hand, purchasing a car is quite easy in Cambodia. Whether you’re a foreigner or local, you’ll just need to present a valid passport (for foreigners) or a valid I.D (for locals), valid visa (for foreigners), and certificate of residence.

All procedures and other requirements needed for the purchase are indicated in the Car Registration System website.

Meanwhile, although cars are convenient and can take you to a lot of places, buying your own home first is the wiser of the two options.

There are plenty of ways to make home buying more affordable and easy in Cambodia, on top of it is home loan. There are numerous banks and and micro finance firms that offer financial services for locals.

Small lenders typically offer lower amount of loans, for instance a loan for setting up a small shop or personal loan. On the other hand, Cambodian banks provide more options and higher loans which extend to property buying. It can lend up to 60% of the total value of the property with around 10-12% annual interest.

However, as a foreigner, it can be very difficult to secure a loan from any local banks since there’s no clear information on loan applications for foreigners. This means that the best option is to go with an international provider, like HSBC, Canadia Bank, ABA, Public Bank Berhad, Vattanac Bank, and RHB Cambodia. All banks mentioned specialise in international market and provide services in English.

Continue reading to know more reasons why you should buy a home first before buying your own car…

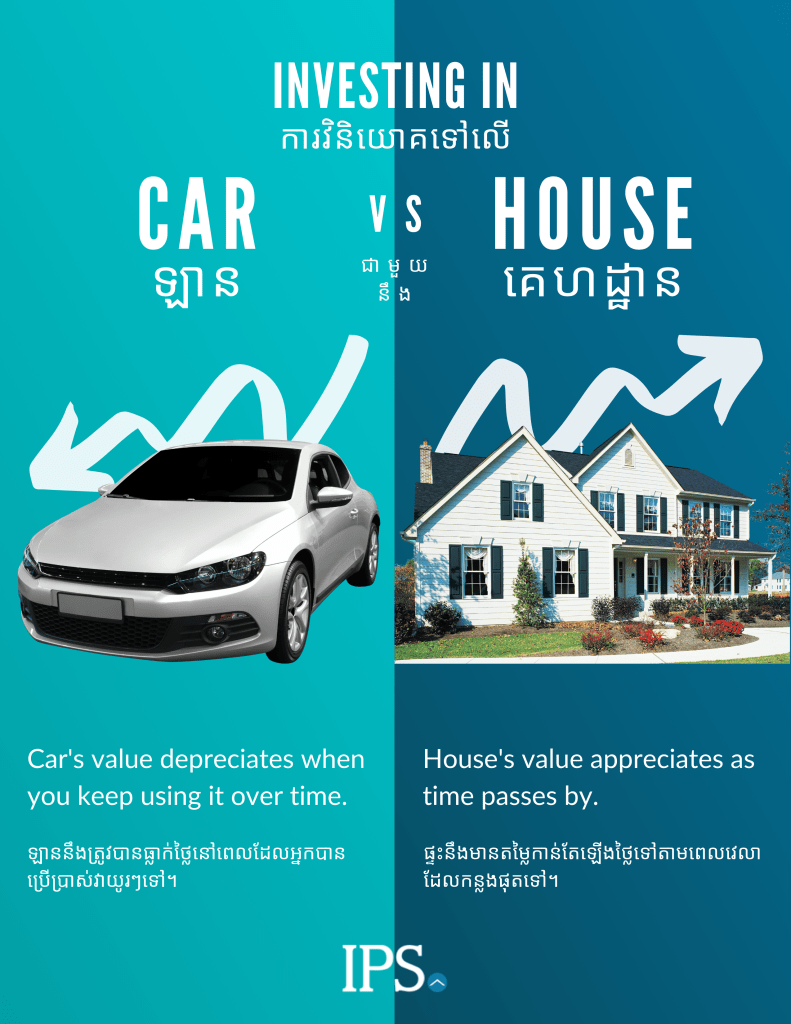

Real estate appreciates, cars depreciate

Whether you buy a house or a condo, one thing is guaranteed when you invest in real estate: its value will increase over time. This means, you can buy a cheap real estate now and within a few years, you can sell it at a higher price than what you shelled out. Not only will you have made a profit but you will have gotten back the money you used to invest in it.

Profit over time and price appreciation for real estate still depends on the market you invested in but since real estate is always in demand, their value only increases.

Appreciation is not possible when you buy a car, no matter what brand you buy. Since the moment you leave the car dealer’s lot, the value of the car already depreciates. Over time, the car price will continue to lower since new cars are released into the market and older models are sold at a cheaper value.

Length of loan payment

Cars have shorter loan payment terms compared to real estate with it generally ranging from two years up to seven years. Extension after that is not possible although this still depends on where you will get your car loan.

On the other hand, when you get a loan to buy your own home, the loan terms can reach up to 30 years. However, it’s better if you can pay for your house in a shorter span of time since it will free you to invest in other real estate properties to increase your investment portfolio.

Property tax vs sales tax on cars

Buying a car or a real estate property in Cambodia will always have an accompanying tax. Property taxes are paid annually, based on the current value of the place. Cambodia has an average of 0.1% tax on properties so you need to include this in your computation when you consider buying a home.

The great thing when you buy real estate in Cambodia is that if you have property valued less than $25,000 or 100 million riels, then you do not have to pay property tax. Cambodia Property Tax is only applicable to buildings, houses, and land valued more than 100 million riels.

On another hand, when you buy a car, it’s a sales tax and will only be paid when the car is bought. Since it’s a one-time payment, the tax is often expensive with an average of 4.87%.

Difference in insurance coverage

Insurance is a necessity especially when you buy properties, vehicles, and more to guarantee that you are covered in case of damage. Property insurance policies offer more coverage options for your home compared to car insurance that does not cover the entire car.

Car insurance policies generally applies to the following:

- Personal accidents → Car insurance covers personal accidents in case of permanent disability or death caused by an accident in the car.

- Third party coverage → The insurance covers damage for bodily injury or death in case of an accident caused by another car.

This means that even if you file different car insurance, all situations or even the entire car, cannot be covered due to the limited options available. On the other hand, property insurance covers a wide range of situations and alternatives to the insurance you’ll get. Here are the three main types of property insurance:

- Actual cash value → In case of property damage, the insurance pays the tenant or owner the replacement cost. However, depreciation is factored into the computation since it’s subtracted to the replacement cost.

This means the insurance does not pay the renter or owner with the value of the property but what its value is after depreciation has been subtracted.

- Replacement cost → In case of property damage or loss, this type of insurance pays the amount necessary to replace or repair the property.

- Extended replacement cost → When you have this type of property insurance, you are only covered the amount to replace or repair the property. This generally only applies to the cost to restore the property and not the actual value of the home.

Considering the above, if you invest in a home first, it means you are more covered in case something happens. Additionally, property insurances secure your financial stability better than car insurances.

Profit

When you buy real estate, you have the opportunity to make money from properties by renting it. It’s passive income that increases your monthly cash flow and secures your financial standing. Additionally, you can even use the profit you earn from it to pay for your mortgage.

Passive income when you buy a car is not possible. If you want to profit from a car, one of the possible options is by using it to drive people around. However, this means you have to spend time and effort to do so unlike in real estate where you just find a renter and profits come in monthly.

Apart from the mentioned ones, here are a few more financial benefits of investing in a home in Cambodia.

- The potential for capital gains. When you buy a home, you are essentially buying an asset that has the potential to appreciate in value over time. This means that you could potentially sell your home for more than you paid for it, making a profit on your investment.

- The tax benefits. There are a number of tax benefits associated with owning a home. For example, you may be able to deduct mortgage interest payments and property taxes from your taxable income.

- The stability of homeownership. When you own your own home, you have a place to live that you will not have to worry about losing. This can provide you with a sense of security and stability.

- The lifestyle benefits. Owning a home can give you a number of lifestyle benefits, such as the ability to have a pet, garden, or customize your space.

Choose the right home for you

When you are ready to invest in a home, make sure you do thorough research to find the right property in Cambodia for you. Additionally, whether you buy a house or a condo, consider the factors above so you’re guaranteeing that you’re investing wisely.

Frequently Asked Questions

What is the cost of buying a home in Cambodia?

- The cost of buying a home in Cambodia varies depending on the location, size, and condition of the property. However, in general, you can expect to pay between $25,000 and $250,000 for a home in Cambodia.

How can I finance a home in Cambodia?

- There are a number of ways to finance a home in Cambodia. You can get a mortgage from a local bank, or you can use a foreign currency mortgage. You can also get a loan from a friend or family member.

What are the best places to buy a home in Cambodia?

- The best places to buy a home in Cambodia depend on your individual needs and preferences. However, some popular areas include Phnom Penh, Siem Reap, and Sihanoukville.