When investing your hard-earned money in properties, it is important to understand how your investments will perform financially. Financial returns can have a profound impact on the profitability and sustainability of your investments.

Therefore, it is essential to gain a clear understanding of the different aspects of financial returns in real estate, particularly when it comes to cash flow and capital gains.

Cash Flow Analysis

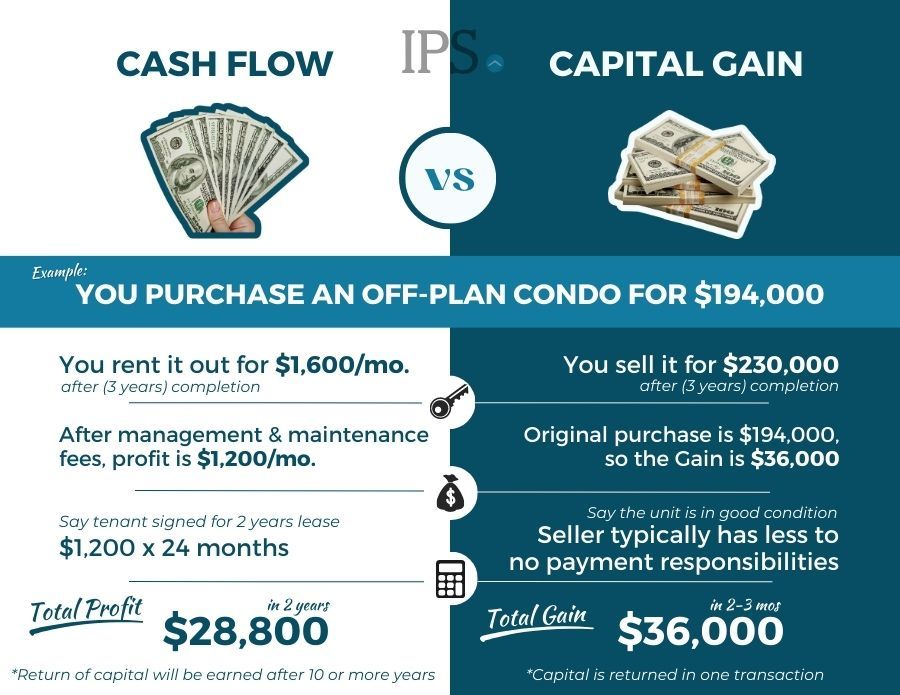

Cash flow analysis is an essential element of real estate investment, especially in determining whether a property can consistently earn income after expenses. This analysis assesses the inflow and outflow of cash over a specified period, analyzing the rent generated in comparison to other expenses such as utilities, taxes, insurance, and maintenance.

Furthermore, rental income is the foundation of cash flow and demands a thorough evaluation to verify that positive cash flow is achievable. Without proper cash flow analysis, negative cash flow could arise, resulting in costly investment errors.

Advantages of investing for cash flow

- Stable Income: Investing for cash flow provides a consistent stream of income, offering financial stability and the potential for regular profits.

- Equity-building: Positive cash flow properties help build equity over time, increasing the property’s value and potential for long-term wealth accumulation.

- Passive Income: Cash flow investments can generate passive income, allowing investors to earn money without actively working or being tied to a traditional 9-to-5 job.

Disadvantages of investing for cash flow

- Location Constraints: Properties with positive cash flow are often located in less desirable areas, limiting the potential for long-term appreciation in value.

- Higher Management Requirements: Cash flow properties may require more active management, including tenant turnover, property maintenance, and dealing with potential rental issues.

- Lower Upside Potential: Investing solely for cash flow may sacrifice the potential for higher returns through capital appreciation.

Capital Gain Analysis

Capital gain refers to the increase in the value of a property over time. It is the profit earned when the property is sold for a higher price than its original purchase price. Factors such as location, market trends, economic growth, and development plans impact the potential for long-term capital appreciation.

While investors can make informed decisions based on these factors, it is vital to note that capital appreciation is not guaranteed and the real estate market can be volatile.

Advantages of investing for capital gain

- Potential for High Returns: Investing for capital gain offers the potential for significant profits if the property appreciates in value over time.

- Leveraging Market Trends: By understanding market trends and investing in areas with high growth potential, investors can capitalize on the appreciation of their properties.

- Diversification of Portfolio: Investing for capital gain allows investors to diversify their portfolio and spread their investment risk across different properties and locations.

Disadvantages of investing for capital gain

- Market Volatility: The real estate market can be unpredictable, and investments made solely for capital gain are susceptible to market fluctuations.

- Longer Investment Horizon: Investing for capital gain often requires a longer investment horizon, as properties may take time to appreciate significantly in value.

- Lack of Immediate Cash Flow: Unlike investing for cash flow, investing for capital gain typically does not provide immediate income, as the focus is on long-term appreciation rather than regular cash flow.

Cash Gain vs. Capital Flow

| Capital Gain | Cash Flow |

| Represents the profit earned from selling a property for a higher price than its original purchase price. | Represents the income generated from a property through rental payments. |

| Generally involves a long-term investment horizon, as it is realized when the property is sold. | Can provide regular income on a monthly or annual basis. |

| Dependent on the appreciation of the property’s value and market conditions. | Dependent on rental income and the property’s operating expenses. |

| Usually not immediately realized and may require capital investment upfront. | Can provide immediate cash returns, helping to offset expenses or generate passive income. |

| Subject to market volatility and fluctuations in property values. | Relatively stable and predictable, depending on the stability of tenants and market rental rates. |

| Typically focuses on potential future profits, as it involves selling the property. | Focuses on generating ongoing income from the property. |

The consideration of capital gains and cash flow has a significant impact on investment decisions. Depending on an investor’s goals, risk tolerance, and financial situation, they may prioritize one over the other.

Investors emphasizing capital gain seek properties with strong growth potential and prioritize the property’s appreciation over time. In contrast, investors who prioritize cash flow seek properties with positive cash flow that generate regular income, which is suitable for those looking for immediate returns or passive income.

Tips for Investing in Real Estate

Maximizing returns in real estate investing requires careful planning and strategic decision-making. Here are five tips to help you succeed in your real estate investment journey:

1. Research and Due Diligence: Conduct thorough research on the market, properties, and potential locations. Analyze comparable sales, property conditions, and any potential risks or liabilities.

2. Diversify your Portfolio: Explore different property types, such as residential, commercial, or industrial properties. Additionally, diversify across locations to tap into various markets with growth potential.

3. Long-term Investment Horizon: Real estate investing is often a long-term commitment. Focus on properties that have the potential to increase in value over time and avoid short-term speculative investments.

4. Cash Flow Considerations: In addition to capital gains, pay attention to cash flow. Consider investments that provide positive rental income, which can help offset expenses like mortgage payments, maintenance, and vacancy costs.

5. Network and Professional Support: Build relationships with professionals in the real estate industry, such as real estate agents, property managers, and contractors, to gain valuable insights and guidance in making informed decisions.

So, have you decided which financial gain you want to achieve? Contact us to get started on your Cambodia property investment!