Cambodian Real Estate Market: Return On Investment

“Are you looking to buy property for a home or as an investment?”

It’s one of the first questions a prospective buyer will be asked by an agent or vendor, but why does it matter? The difference is this; when buying a home, it’s an emotional decision where monetary returns are set aside in favour of thoughts of comfort, homeliness, and happiness. On the flip side, a good investment in Cambodian property will provide you with a return on your investment in the form of rental income and capital growth which will allow you to grow your overall wealth.

In the Cambodian real estate market, whether it be land, villas, condos or apartments, a good proportion of buyers, especially foreigners, buy property as an investment.

Let’s look at the different forms of return; rental yield and capital growth.

Rental yield is the rate of income return over the total purchase cost associated with an investment property with the income coming in the form of rent. To put it simply, it is how much more you’re making on an annual basis versus your initial investment. Currently, annual rental yields in Cambodia of between 6% – 8% are still very much attainable. Having a property tenanted is extremely important to achieving your desired Return On Investment (ROI) as the rental income for apartments in Cambodia constitutes the majority of your investment return. Residential leases here are generally 12 months, provide a regular and dependable income stream which should produce positive cash flows when compared with most investment alternatives.

Capital growth is the appreciation in the value of an asset over a period of time, usually expressed as an annual percentage. An average rate of capital growth in Cambodia is extremely hard to pin down as rates vary greatly according to property type and location. For example, current capital growth on a renovated apartment can range from 1% – 5% annually. Whereas capital growth on land in Chbar Ampov can vary from 3% – 20% (note that generally, land does not provide an income stream).

Whilst capital growth and rental yield are often looked at separately, they can actually be directly related to income-producing real estate investments can often provide excellent appreciation in value. This is because properties usually increase in value when the net operating income of the property improves through rent increases and effective management of the property.

As a rule, I recommend IPS investors look at properties that provide an immediate income stream, that is, a property that is ready and desirable to rent. Having the option to buy “off the plan” has been a recent development in Cambodia, however, whilst buying off the plan may be desirable due to the fact that you don’t need 100% of the funds upfront (installment payments are made), the reality is that you have to wait until the project is completed (effectively taking on project risk) and handed over before you can get return on your investment. Here in Cambodia, this can mean waiting for 2 years or more, during which time your money is not working for you and your only ROI – capital growth – is purely at the mercy of the market.

One of the most popular products we have on the market for investors is newly renovated apartments in central Phnom Penh. A tastefully renovated apartment in a central location with a good entrance is extremely rentable and can provide returns of over 10% per annum.

Let’s look at two real world examples to understand the returns available from these types of properties:

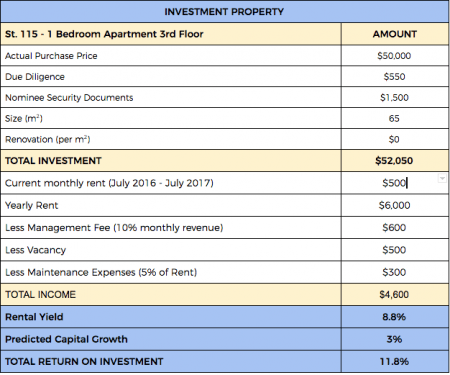

PROPERTY 1 – 1 Bedroom, 53 m2 apartment located in 7 Makara (central Phnom Penh)

This property was purchased by a foreign investor in July 2016 and to be completely upfront, was picked up for a bargain. Taking into account the due diligence background check and set up of the nominee security documents the total outlay was less than $53,000. It took one month to find a tenant, our client pays us a monthly fee to manage the property on his behalf. Taking all this into account our client makes a very healthy 8.8% rental yield and when you factor in a modest capital growth the total return on investment comes in at just under 12% per year. This is a brilliant little investment.

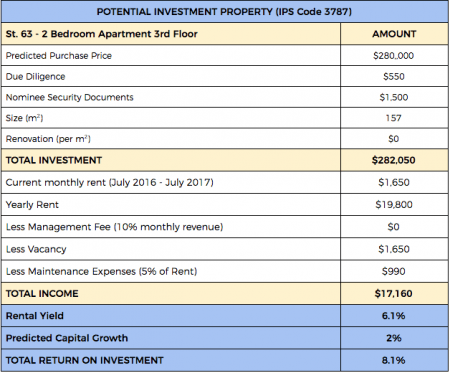

PROPERTY 2 – 2 Bedroom, 157 m2 Penthouse apartment located in BKK1

The table above shows the breakdown of the initial investment, including the purchase price, due diligence on the property and set up of the nominee documents (assuming the buyer is a foreigner); the total investment outlay is $282,050. The property is already tenanted until October 2017 with rent locked in at $1,650/month, but erring on the side of caution we still factor in one-month vacancy and some maintenance on the property. The breakdown is quite conservative and it still delivers a solid 6.1% rental yield. When you add on a moderate capital growth of 2% the total ROI reaches 8.1%.

These properties are just two examples of what is available in the market and the returns on offer. There are properties out there to suit all budgets and investment criteria, it’s just a matter of finding the right property for you. With a bit of market research and the right real estate partner, the Cambodian property market can be a fantastic place to invest and increase your wealth

Pingback: Cambodia Real Estate Market in 2019

Pingback: ទីផ្សារអចលនទ្រព្យនៅកម្ពុជាឆ្នាំ 2019 -

Pingback: Cambodia Real Estate Market in 2019 - Cambodia Property News