A Comprehensive Guide to Making Money Through Real Estate in Cambodia

Understanding Real Estate Investment in Cambodia

Real estate investment is generally considered as the safest bet since shelter is a basic human need. Other investments, like stocks and bonds, have higher risk because its prices often change due to market conditions. While in real estate, the property value grows over time.

But the purpose of this article is not to make anyone feel complacent with their investment. Investing in real estate property in Cambodia still needs knowledge and a learning process. So, here’s what you need to know about real estate investment in Cambodia:

Real estate investment is an act of buying or owning properties such as houses, lands, and buildings (including air and underground rights which are above and below the land, respectively) to achieve a profit.

Note: In business terms, buying property for residence or for your own occupancy is not considered an investment but an ownership.

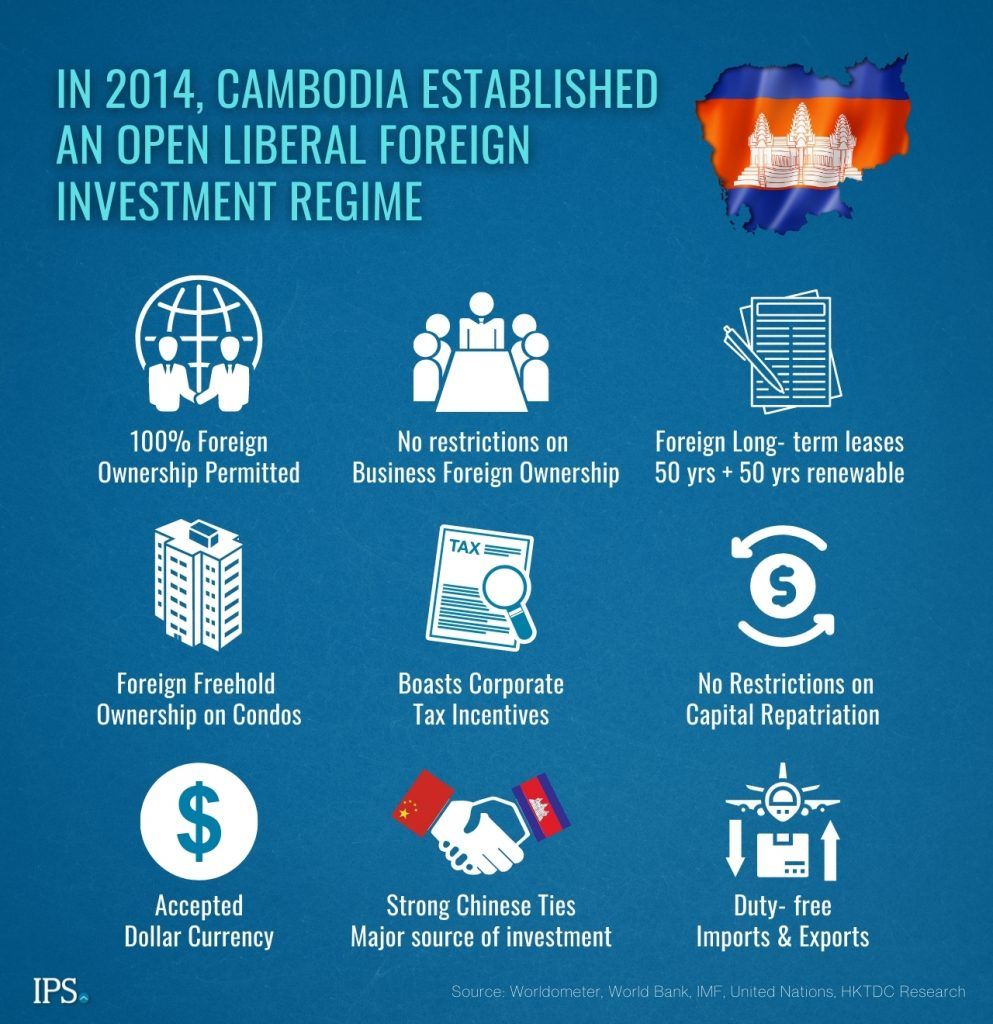

As stated in Cambodia’s Law on Investment (1994), all sectors of the economy are open to foreign investment. Most sectors permit 100% foreign ownership while few require certain conditions and prior authorization from authorities. The Cambodian government has put foreign investment as priority in the export sector, establishing a relatively pro-investor policy and legal framework.

Companies in Cambodia can be fully owned by foreigners, alongside some incentives including a 20% corporate tax rate after the incentive period ends, a corporate tax holiday of up to eight years, no restrictions on capital repatriation, and duty‑free imports of capital goods.

Under the Law on Investment (1994), foreigners are only allowed to own Strata titled properties, normally condominiums, under their own name. Foreigners can also hold long‑term leases for up to 50 years, renewable for another 50 years.

Strata title Qualifications:

- Registered at Ministry of Land Management

- Only applies to new buildings from 2010 onwards

- Foreign ownership is limited to 70% of the total surface size of all units in the building.

- Does not apply to units on ground floor or underground floor

- Does not apply to properties within 30km of any land border

Note: Foreigners are restricted from owning lands such as ground floor, first floor and second floor apartments, house and lots, lands or any other type of property in hard or soft title.

Learn how can foreigners own a land in Cambodia, click here: Ways for Foreigners to Own/Have Rights to Land Property

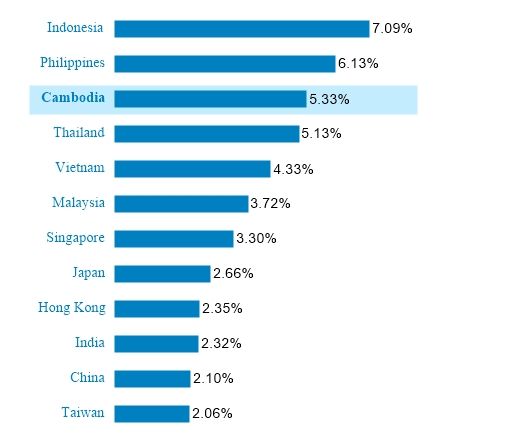

Cambodia ranks 5th among the fastest-growing economies in Asia in 2020–2024 GDP growth forecast. For the past two decades, the country has sustained an average growth rate of 7% — an average of 8.3% from 2000 to 2003, then 11.1% in 2004 to 2007, and an average of 7.2% per year from 2011 to 2019. Cambodia’s economy this year (2021) is projected to contract by 1.6% due to the COVID-19 crisis, according to the International Monetary Fund (IMF).

In August 2016, the World Bank upgraded the country from low-income to lower middle-income status and is hoping to attain upper-middle-income status by 2030. Cambodia’s GNI per capita stood at US$1,230 in 2017, and increased to US$1,480 in 2019, and the country’s poverty rate has fallen from 47.8% in 2007 to 12.9% in 2018.

In the investment side, providing housing for the growing population of foreign teachers in the country, employees in BPO and IT-BPM industry, and for those who want to live near their offices or those looking for job opportunities in the the city, are factors driving the demand for residential units and condominiums in Phnom Penh, as well as commercial properties and mixed-use projects that provide the needs of these tenants or homeowners.

The growth of the property market extends to provincial cities including Siem Reap and Sihanoukville, where both serve as prime investment locations for those looking for Phnom Penh-like business lifestyles outside the capital city.

Since the country has a developing economy, no shortcomings in opportunities are in sight, especially since more people are moving to urban areas and adopting urban lifestyles. For local and foreign investors, this provides plenty of good reasons to invest in property and grow their money.

Lastly, recent projects and developments initiated by the government like improving road networks and expansion of airports are some factors that should drive the real estate sector even further.

As huge as the opportunities it offers, real estate has numerous types of properties that leave you with diversified investment options and strategies. But sometimes, we don’t really need to reinvent things—we just need to realign them.

With lots of options on the menu, when it comes to investing in real estate, picking the classic, same old methods or formulas still work. Property investors or developers in Cambodia can earn from any of these tried and tested real estate that are generating huge and continuous profit today:

CONDOMINIUMS

Condominiums are gaining high demand for the convenience it serves. Because condos are concentrated in cities (mostly in Phnom Penh), it is filling the needs of people to be near their work and avoid being in a traffic hassle.

The demand began to surge in 2014, mainly by foreigners including Chinese, Singaporean, Taiwanese, Malaysians, Koreans, and Japanese.

Deemed as profitable due to its steady demand and increase in condo projects, the biggest chunk of available condos belong to high-end (Grade A) segment, which makes up 61% of the total pie.

Mid-tier (Grade B) condominiums take the latter, mainly catering to domestic buyers. With increasing middle-class Cambodians looking for a place to live in the city or venture into lease industry, Grade B is expected to grow in the coming years.

Perfect for rentals, offering mid-tier condominiums to professionals, and start-up families can give huge returns, as well as buying to sell to foreigners. Also ideal is Airbnb targeting people looking for condo or condotels for short business trips in the city.

Meanwhile, wealthy Cambodian families and Chinese expatriates are the ones that can only afford luxury condominiums.

APARTMENTS (Serviced/Shared/Single)

Apartments for rent are certainly the most stable market for its affordability, and you’ll be surprised by the sheer demand of this type of property.

You’ll never run out of tenants if you have an apartment in a safe and accessible location. There are many students (from provinces) studying or seeking opportunities in the city. Locals and foreigners working in central business districts are also searching for a home away from their home – preferably nearby schools, workplaces, hospitals, etc. Extra points if it’s near a supermarket or convenience store.

Students and some workers who have low budget prefer shared apartments or shared flats. While people with mid to high paying jobs are more willing to rent serviced apartments.

Because serviced apartments offer basic amenities and services like cleaning and security, the lifestyle appeals for most expats. Apartments, in a nutshell, offer a relatively high occupancy rate as it offers an attractive alternative to increasingly more expensive condominiums.

HOUSES (Townhouse/Shophouse/Borey)

Beginning in the year 2000, Cambodia (particularly Phnom Penh) saw a boom in the housing market. Furthermore, places like Takhmao, Siem Reap, Sihanoukville, Kampot, and other regions are also witnessing the surge in demand for residential properties.

As families are getting more modern and bigger, people are more willing to secure their own houses for privacy and convenience. Another reason is that more and more people are starting to see the benefit of starter homes and affordable housing as an investment.

So, singles, long-term couples, newlyweds, and even long-time married couples would rather pay for amortization (which is an asset) rather than paying rent (which is an expense).

Boreys offering variety of properties, like Linked Houses, Shophouses, Twin Villas, Queen & King Villas, are popular among locals particularly young couples and newlyweds. These developments are mostly located in suburbs of Phnom Penh due to over saturation of commercial developments in city center.

VACATION HOMES

Cambodia is among the most popular tourist destinations in Southeast Asia. Breathtaking temples, lush mountains, pristine bodies of water and amazing historical sites await travelers both local and abroad.

The vast ruins of Angkor Wat in Siem Reap, the capital Phnom Penh with the Royal Palace, Independence Monument and the promenade of the Tonle Sap, and Sihanoukville’s surrounding beaches are some of the most popular spots that receive thousands of travelers and backpackers every year. And these visitors need a place to stay, which you’ll earn by providing them just that.

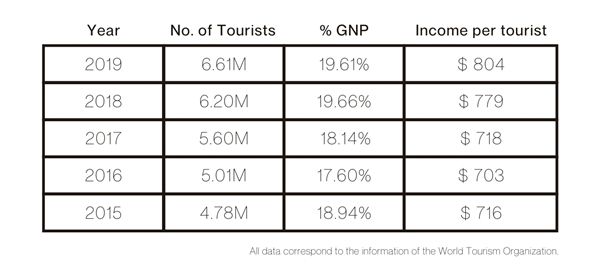

Interestingly, Cambodia ranked 55th among the most popular travel countries in the world. It recorded a total of 6.61M tourists in 2019 earning 804 USD per tourist, which also equates to over 6 million travelers looking for a convenient place to stay.

WAREHOUSES

As e-commerce industry leads the market, the demand for warehouses and other types of storage sites are on the rise. Plus, the garment and manufacturing industry are major drivers of Cambodia’s economy.

Some investors have already made investments towards the current boom in logistics industry. These massive warehouses provide spaces for storage, packaging, shipping operations, manufacturing, and research – all under one roof.

COMMERCIAL SPACES

Whether it’s retail or convenience store, restaurant, coffee shop, bank, an agency or small company – all of these need a space to operate their businesses.

Commercial spaces can provide profitable investment for a considerable period of time. Lease contracts for commercial buildings can last for a minimum of 5 years up to 10 years. So, just imagine if you closed a deal – a single or multiple units with one steady-paying tenant each – you’re assured of a monthly income for decent amount of time.

This type of investment also attracts wide range of tenants. You may choose to establish your own business by renting or buying a space, or be that landlord that offers business space for lease.

Highly concentrated in cities, your target market are employees and city residents who appreciate conveniences such as laundry shops, mini marts, banks, fast foods, and shopping centres.

RESIDENTIAL & COMMERCIAL LANDS

There’s a huge supply of vacant lands in Cambodia. Some lands are left unused, some have a house or establishment, some are found in suburbs, and some are in between residential and commercial buildings.

Plots with distressed houses in an otherwise attractive neighborhood are usually taken advantage of by investors. They purchase it for cheap price, build beautiful house, and either rent it out or sell it at higher price.

Vacant lots also carry the same potential to be profitable. You just have to consider the location, price, and determine which type of property you can build on it.

BUY > SELL

Property rises in value over time and that’s a common knowledge in real estate. Classic buy-and-sell move is the act of buying a property > the property increases in value > then you sell it for profit. But of course, not all property values go up and that’s the risk you’re taking in real estate investment.

An ideal property to buy and sell is a pre-selling or off-plan property. This type of property is offered at a lower price since you’re buying it during the planning stage or construction period. As it nears completion, the value of the property increases. By the time it’s complete, you may choose to lease it out or sell it at a much higher price (than the pre-sale price).

In an interview with Damian of Asia Bankers Club, he told a story about Chinese people buying condominium units as if they’re buying handbags. While he was on his way to a showroom in Vietnam, he saw a group of Chinese tourists from a bus, and they just start seeing projects and buy units from it.

The strategy that investors could pick up from this is what Damian called the “China effect,” which they applied during pandemic. This strategy requires investors to buy today, so once the borders are already open, investors can resell it to Chinese investors at a premium price.

Another is buying low and selling high. The key to this type of buy-and-sell method is finding the right location; one that’s still undeveloped so the property prices are still low, yet envisioned to be a wealthy area with upcoming developments in the future.

BUY > LEASE OUT

Cambodia is the third country with the highest rental yield in Asia, based on Global Property guide. Residential rental is a familiar form of real estate in the country, either as tenants or landlords. Commonly, people buy property at affordable prices and rent them out at marked-up rates.

If you’re looking into this route, the key factor is finding a convenient location. “Convenience,” in real estate, means being near to commercial business districts, universities and hospitals. Since you’re catering to professionals, students, and city families, you’ll never run out of tenants.

Rental prices in Cambodia remain at a reasonable rate, with condominiums offering the highest yields for real estate investors. In Phnom Penh, rental units bring exceptional yields since this is where expats (students and employees), foreign business owners, and other high-paid workers mostly work and stay.

The increasing demand for condominium and apartment rentals in the past few years is due to the rise of middle-class Cambodians who want the perks and convenience of living in the city. These people highly consider their residence to be closer to where they work or study due to the increasing traffic in Phnom Penh. More and more people also come from the countryside to work in the city for better-paying jobs.

If you don’t have the money up front to invest, you may buy a unit at monthly installment and set it up for rental. Your monthly rental income should be enough to cover the amortization that you’re paying as the owner of the unit. Once fully paid, the income from the rental can dramatically increase and you can save it or reinvest on the purchase of other units.

RENT > SUBLEASE

It is possible to rent a property in Cambodia and lease it out for income, which is also known as “sub-lease.” However, this agreement only applies when you rent huge establishments or entire buildings such as apartments for rent and hotels for rent.

For instance, the landlord of this seven (7) bedroom villa for rent in BKK1, Phnom Penh allows the future lessee to occupy the property for the purpose business. You may offer this in the market as a guesthouse or a shared apartment. Additionally, when you rent a building, you’d be looking at an absolute minimum of 3 years to 5 years lease period. Note: Single properties’ (e.g., condominium units) lease contracts do not permit a sublease.

BUY/RENT > ESTABLISH BUSINESS

Instead of chasing tenants by leasing out a property, you can also establish a business that caters to their needs. Expats always look for convenience and grocery stores to run to in the middle of the night. You can also earn great income from putting up a restaurant or coffee shop near offices.

Having a physical store in a high footfall location or strategic spot provides businesses an optimal exposure. For brand awareness, you may want to venture into online shops to target modern people who prefer delivery rather than visiting stores.

Buying a commercial space offers expansion opportunities and freedom to deconstruct the property into the business you’ve imagined it to be. Meanwhile, renting provides you more options as there is more ‘for rent’ supply in the market than ‘for sale.’ Thus, you’ll have a higher chance of getting a space in your desired downtown location if you rather choose to rent.

BUY > DEVELOP > SELL/LEASE OUT

More often than not, lands are priced lowest in real estate particularly undeveloped plots. If you want more freedom in establishing your own real estate investment, then this one’s for you. Since you’re buying a vacant land, you’ll be able to build any property that you want; choose the materials you prefer; and incorporate your desired style and design.

Cambodia receives millions of tourists every year so building a hotel can generate great cash flow. Other developments that produce income are condominiums, Boreys, apartments, commercial spaces, warehouses, etc. When the development is already complete, you can either sell or lease it at its perceived higher value.

BUY > RENOVATE > SELL/LEASE OUT

When people browse for properties, they would often look for nice designs, clean finishing – no need for fixing & repairs. What they don’t realize, even unattractive properties have the potential to generate profit. Most investors actively seek for the worst homes in a thriving neighborhood for wholesaling or house flipping.

To simply put it, house flipping is the act of buying distressed or abandoned properties, fixing them up, and selling them at a higher price. This could take a lot of work but if you have a good eye in finding properties that are promising and profitable after fixing, then it could be your best investment yet.

In choosing a property to flip, you need to consider these four aspects to easily sell or lease out the property:

- Target market’s needs (commuter vs car owner)

- Surrounding developments (distance to markets, hospitals, schools, etc.)

- Current condition (roads, traffic, flood, etc.)

- Future growth (future roads and commercial establishments)

Additionally, you should also calculate how much money you spend on renovations so you could still make a return. Don’t make the mistake of spending too much on renovations and later having difficulty in selling the property. Always do the math.

PHNOM PENH

Welcome to the largest city and the capital city of Cambodia, Phnom Penh.

Phnom Penh is a prime location for investments and businesses in the country. The city continues to grow at a rapid rate and continues to attract investors, tourists, entrepreneurs, workforces, students, and other people who desire to live an urban lifestyle.

Based on our data, Phnom Penh receives the most client inquiries mainly asking for condominiums for sale, mid-tier apartments for rent, villas for sale, business spaces for rent, and others are availability of warehouses and lands.

As the most populated city in Cambodia, you can almost guarantee that you’ll get inquiries from interested buyers and would-be tenants if you invest in Phnom Penh. When choosing a location, aim for properties in or around business districts for best results.

Not to mention, numerous multinational firms have also set up main offices in Phnom Penh, transforming the city into a highly developed commercial center.

TA KHMAO

Situated just ten (10) kilometers to Phnom Penh, Takhmao city has been attracting more real estate developers, mostly residential housing projects, which underpinned Takhmao’s potential as a new investment hub.

A lot of developments are on the rise in the south of Phnom Penh, including Aeon 3 and New Phnom Penh International Airport along Samdech Hun Sen Boulevard–a new and becoming commercial center in the city. Luckily, Takhmao is just around this area.

Construction of better roads would also enhance the transportation experience of commuters from Phnom Penh to Takhmao and vice versa. Real estate experts believe that since Phnom Penh is almost saturated, developers would soon seek for new areas to build projects and Takmao’s close proximity to Phnom Penh presents great potential. Additionally, there are still plenty of lands available in the south of the city which are cheaper compared to areas in and around the capital city.

SIEM REAP

Siem Reap city is the “Tourism Haven” of Cambodia, so it’s not surprising that it is also a hotspot for real estate investments in the country.

With Angkor Wat and other historical ruins found here, Siem Reap has drawn thousands of tourists and retirees every year. The city also enjoys abundance of natural wonders like the nearby Kulen Mountain, and a lighter traffic system.

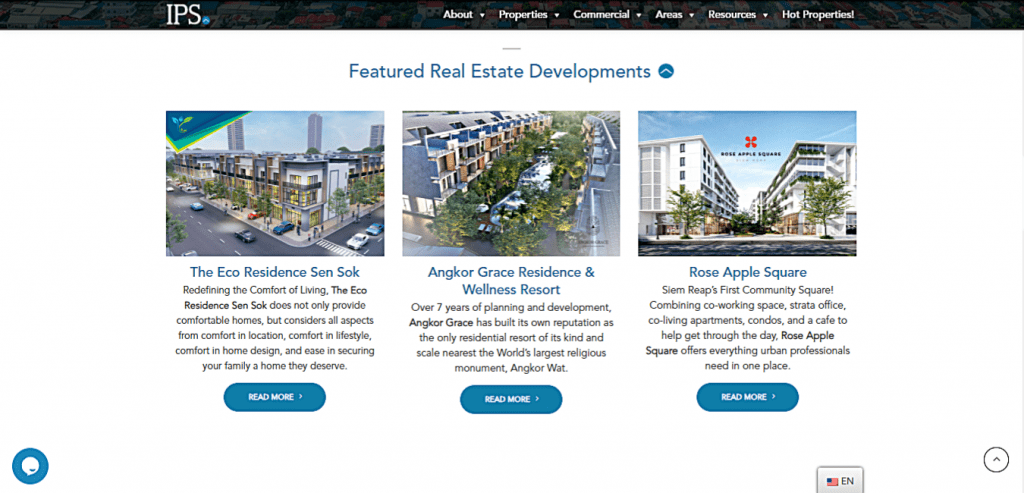

The most preferred investments here are vacation homes, hotels, resorts, and short-term rentals. However, more master-planned communities are starting to rise here, including Angkor Grace Residence & Wellness Resort and Rose Apple Square mixed-use development.

Envisioned to become the next Phnom Penh city, the government has organized a masterplan for Siem Reap to attract more commercial developments and create more job opportunities, so that people wouldn’t have to leave Siem Reap to seek better employment in the capital city.

To know the upcoming development in Siem Reap, click here: Siem Reap: The Next Economic Powerhouse of Cambodia

KAMPOT

Kampot is known as the go-to beach destination for staycations or quick getaways. The location is perfect for those who want to live in a more peaceful environment than Phnom Penh that’s too urbanized.

Kampot and Kep provinces have strongly been attracting more and more domestic arrivals, especially during the Covid-19 pandemic. Thus, local real estate experts see this as a great potential for developing more resorts in these provinces.

In fact, over 200 development projects and four major tourism development destinations have been drafted in the Kep Tourism Master Plan which is set to transform Kep into a “high-end luxury tourism destination.”

Meanwhile, Kampot has also welcomed numerous development projects including the tourism port in Teuk Chhou district, the province’s very first golf course “Forest Harmony,” an artificial beach, and the Coastal Business Centre.

Generally, buying property in Cambodia is as simple as completing all requirements, paying, and obtaining the property title.

But while the process may sound simple, there are various steps involved depending on the type of property being bought. It usually takes a month or so to get all of the following steps completed:

1. Go to Real Estate Agency

By asking assistance from a real estate agency like IPS-Cambodia, you’re sure that there would be a professional sales agent ready to assist you with your property needs and concerns, and guide you through the complete process of buying property.

2. Select Property

Select your preferred property and the payment option. After that, secure your unit by paying a booking fee (usually $1,000), then you’ll be appointed with a schedule for signing the Sales & Purchase Agreement (SPA) moving forward.

3. Submit Requirements

By entrusting IPS Cambodia to handle the purchase process, here are the details that we need when preparing the contract:

- Copy of Passport / valid ID of the Buyer

- Copy of Passport / valid ID of the Owner

- Copy of the title (from the Owner)

- Confirmed purchase price & payment terms (signed by the Buyer)

- Copy of electricity/utility bills (from the Owner)

- Inventory list of furniture and fittings (from the Owner)

4. Complete Payment Process (10-40-50 Rule)

After a deal between the buyer and seller has been made regarding sale of the property, then comes the payment process:

- 10% Downpayment upon confirmation to purchase property

- 40% First payment upon signing of the Sales & Purchase Agreement (SPA), and processing the transfer of title or ownership.

- 50% Final payment after the title has successfully been transferred under your name (takes approximately 90 days from signing of SPA).

Note: This process applies if either a buyer or seller has engaged a real estate agency to control the transaction to ensure transparency and fairness.

Transaction Fees and Charges related to Before and After Purchase of Property in Cambodia

| Fees & Charges | Amount (USD) | Paid by |

| Non Refundable Holding Deposit | 10% (more or less $5,000) | Buyer |

| Transfer fee | Approx. $1,200 | Buyer |

| Transfer Tax | 4% of property value | Seller |

| Annual Property Tax (after owning the property) | 0.1% per year (for any property with a value above 25K) | Buyer |

| Agency Fee (if they engage a real estate agent to sell the property) | 3% | Seller |

| Capital gain tax (only applies from 2022) | 4% of sale price | Seller |

Note:

- Non Refundable holding deposit depends on how much the seller asks for.

- By practice, the transfer fee must be shouldered by the seller but can also depend on the negotiation between both parties.

- By law, property owners have an obligation to pay the annual property tax for properties above $25,000.

Finding a property in Cambodia can be easily done with just one click. IPS-Cambodia is an online property search website dedicated to help buyers and investors search for the right property, and help sellers and developers reach the right audience through marketing.

You can start by searching IPS-Cambodia on any search-engine sites like Google.

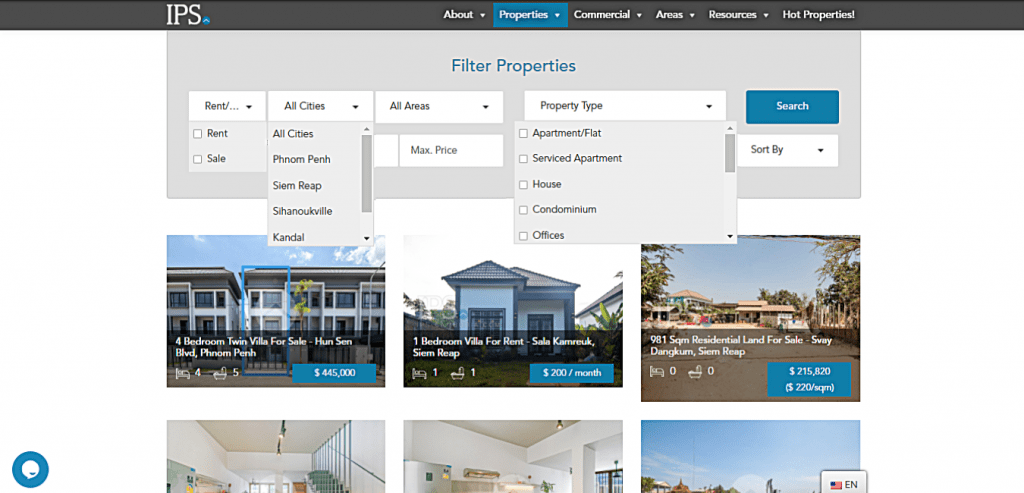

You can easily browse for all types of real estate, from residential to commercial to industrial. IPS-Cambodia website lets you search by rent or sale, property type, specific area, number of bedrooms, and even your minimum or maximum budget.

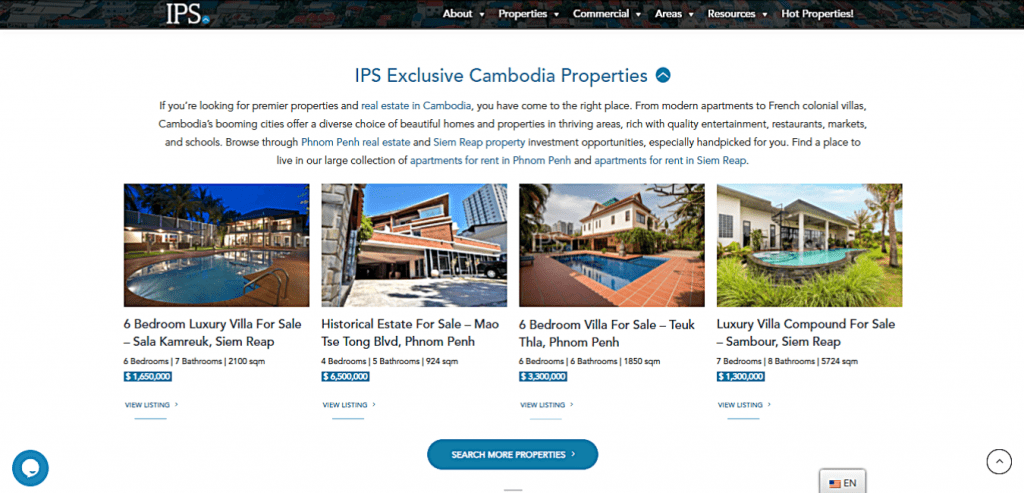

By scrolling down, you’ll see its Exclusive Properties which are only available and can only be rented or purchased through IPS-Cambodia.

Newest developments by the country’s renowned developers can also be found here. Popular developments in Cambodia include condominiums, mixed-use developments, Borey housing projects, and more.

On top of that, the site has useful guides on selling, buying, investing, and relocating in Cambodia under “Resources.” There is also “Book a viewing” button for securing an appointment to view a property, and a “List your Property” button for putting your property up for sale or for rent in IPS-Cambodia site to gain more interested buyers.