UPDATED on Feb. 22, 2023

A comprehensive guide that highlights essential information on starting a business in Cambodia, from setting up a business to taxation and more.

Starting a Business in Cambodia

Cambodia’s open economy creates a lot of business opportunities, not just for Cambodians, but most especially for foreigners. It has no restrictions on foreign business registration which allows 100% foreign-owned businesses to operate in the country with nearly the same rights as local-owned businesses (except for the ownership of the land the business sits upon).

But before making this country your next entrepreneurial ground, here are the significant things you need to know upon starting a business in Cambodia.

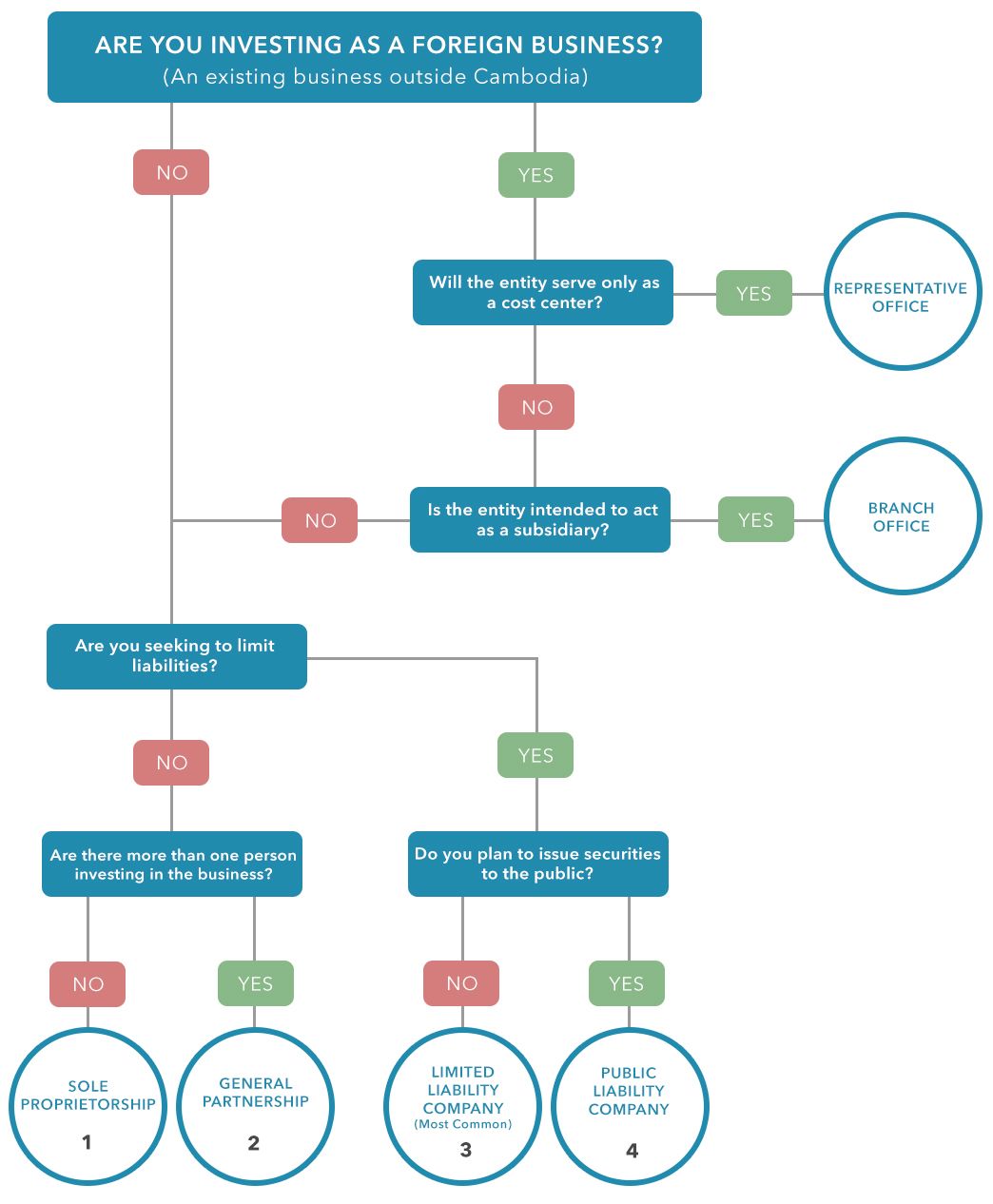

Selecting a business structure really depends on personal circumstances and preferences. But, to be able to decide on the right type of business you’re going to venture on, it might be necessary to ask these questions first:

What type of company structure is right for you?

Use this chart to determine the most appropriate business entity for you.

Each structure has its own pros and cons in terms of liability, operations, taxation, and registration and filing fees. Requirements on business registration depend on the type of business that is going to be established. At present, these are the legal forms of businesses in Cambodia:

BUSINESS ENTITIES COMMON FOR FOREIGN BUSINESSES

1. Sole Proprietorship

A business entity that is owned entirely by a single person. It has the simplest operating structure that is common for small-scale businesses.

Because the owner is the sole proprietor, he/she takes the entirety of all profits and losses, and is fully liable for the decisions, obligations, and debts of the business.

2. Partnerships

General Partnership – A business entity which involves two or more natural persons. Each partner involved is equally responsible for the business actions and decisions; are authorized to administer and bind the partnership, thus are fully liable for all debts and obligations of the business.

Limited Partnership – If the partners agreed on a “limited partnership,” there should be:

- one or more (general) partners who will take full responsibility, who are the high authorities, and who are liable for all the debts and obligations of the business.

- one or more (limited) partners, also known as the “silent partners” that contribute money without having any say in the company, hence are entitled to a share of profits and are only liable to the extent of the sum of money or value of the property that they have agreed to contribute.

BUSINESS ENTITIES COMMON/RECOMMENDED FOR LARGER BUSINESSES

Whilst most foreign entrepreneurs who have set up a company in the Kingdom are under a Sole Proprietor structure, larger businesses will setup under a ‘Limited Liability Company’ structure. This type of business limits the liabilities of shareholders to the capital invested in the company.

3. Limited Liability Company (LLC)

A common form of business and investment that is highly recommended for foreign entrepreneurs in Cambodia as it limits the potential liabilities of shareholders to their investment in shares. This type of business can have between 1 and 30 shareholders to which the minimum capital requirement is only USD$1,000 (or 4 million KHR).

A business entity that gives flexibility to a partnership and the protection of a corporation. It can be 100% Cambodian-owned, 100% foreign-owned, or any combination of both shareholdings that may be subject to certain restrictions. As the name suggests, a member’s personal liability is limited when it comes to business decisions and actions.

Note: Unlike other enterprises, LLC does not require an involvement of a Cambodian investor for it to be run and be established in the country.

Three Types of Limited Liability Company

- Single-Member Private Limited Company – a business entity with one physical or legal shareholder and at least one director, with all advantages of a PLC.

- Private Limited Company – a business entity with two to thirty shareholders and at least one director. It may have some restrictions on the transfer of each class of shares based on the Articles.

- Public Limited Company – a business entity that the law authorizes to issue securities to the public. It must be headed by at least three directors who are elected by the shareholders for a period of 2 years.

Some other business structures that apply exclusively to companies owned by a foreign parent company include;

4. Representative Office (RO)

A business entity that is available to a foreign parent company that wishes to engage in sales liaison and market research activities in Cambodia. The RO is not a separate legal entity from the parent company and is strictly limited in its business activities.

It is only intended as a cost center that holds the same name as the parent company, gathers information for the parent company, enters into contracts on its behalf; but should not offer paid service and derive income from its operations.

The activities that RO may engage in are detailed in Article 274 of Law on Commercial Enterprise (LCE):

- Contact customers for the purpose of introducing customers to its principal

- Research commercial information and provide the information to its principal

- Conduct market research4 Market goods at trade fairs, and exhibit samples and good in its office or at trade fairs

- Purchase and keep a quantity of goods for the purpose of trade fairs

- Rent an office and employ local staff

- Enter contracts with local customers on behalf of its principal

5. Branch Office

A business entity that is still owned by a parent company, therefore maintaining liability with the parent company. A branch office in Cambodia is a less restricted form of business that can, in practice, be engaged in the same business activities as regular Cambodian business.

Responsibility for the debts and liabilities of the branch office are jointly held between the branch itself and the parent company, which makes it a riskier form of entity.

6. Subsidiary Company

A business entity that must be a limited and incorporated company owned by a parent company. A subsidiary in Cambodia must own the majority of shares, particularly at least 51%, of a foreign parent company.

7. Land Holding Company

A business entity that is required to be a limited and incorporated company, with a 51% ownership by a Cambodian national. Such a company is legally able to purchase land and property in Cambodia. The 51% Cambodian shareholding can be held by Nominees who may, through a Power of Attorney and other legal instruments, give control of their shareholding to the 49% minority foreign shareholder.

Note: A business is considered a “Cambodian business” if it has a registered office in Cambodia; whereas 51% of shares is owned by a Cambodian legal person/s.

The enterprises can be classified into four categories namely micro, small and medium sized enterprises, SMEs as they’re known for, and large enterprises. Generally, the SMEs refer to any enterprises with up to 100 employees.

In Cambodia, this is the definition for SMEs:

|

|

Number of employees |

Financial Assets excluding land (USD) |

|

Micro |

Less than 10 |

Less than USD 50,000 |

|

Small |

11 to 50 |

USD 50,000 to USD 250,000 |

|

Medium |

51 to 100 |

USD 250,000 to USD 500,000 |

|

Large |

Over 100 |

Over USD 500,000 |

Source: Small & Medium Enterprises Development Policies in Cambodia

The Law on Financial Management 2016 has restructured the Regime of Taxation into Self-Assessed Regime or The Real Regime of Taxation. According to the law, everything will be done by the company or business itself. From preparing the tax filing, calculating, to actually paying (through the bank) and submitting a receipt to the Tax Department office.

However, the Tax office, at some point, audits all the taxes and evaluates the taxpayers (as indicated on its auditing policy), so the business needs to be knowledgeable about the tax procedure. If not, the business can hire a knowledgeable person or hire a trusted firm to do all the process. IPS can assist with finding an accountancy firm to assist with this.

The Real Regime of Taxation is composed of Small, Medium and Large taxpayers. Below are the qualifications that define what type of taxpayer your business must fall into.

The Three Categories of Taxpayers

1. Small Taxpayers (Small businesses)

Taxpayers that are Sole Proprietorships or Partnerships that:

- Have annual taxable turnover from KHR 250 million (USD $62,500) to KHR 700 million (USD $175,000) or;

- Have taxable turnover, in any period of three consecutive calendar months (within this tax year), exceeding KHR 60 million (USD $15,000);

- Expected taxable turnover of KHR 60 million (USD $15,000) or more in the next three consecutive months and;

- Participate in any bidding, quotation or survey for the supply of goods and services including duties

2. Medium Taxpayers (Medium businesses)

- Enterprises that have annual turnover from KHR 700 million (USD $175,000) to KHR 4 billion (USD $1M);

- Enterprises that have been incorporated as legal entities, representative office or;

- National & sub-national government institutions, associations, and non-government organizations

- Foreign diplomatic & consular missions, international organizations and foreign cooperation agencies

3. Large Taxpayers (Large businesses)

- Enterprises that have annual turnover over KHR 4 billion (USD $1M);

- Subsidiary of multinational companies, branch of foreign companies and;

- Enterprises registered as a Qualified Investment Project (“QIP”) as approved by the Council for Development of Cambodia (CDC)

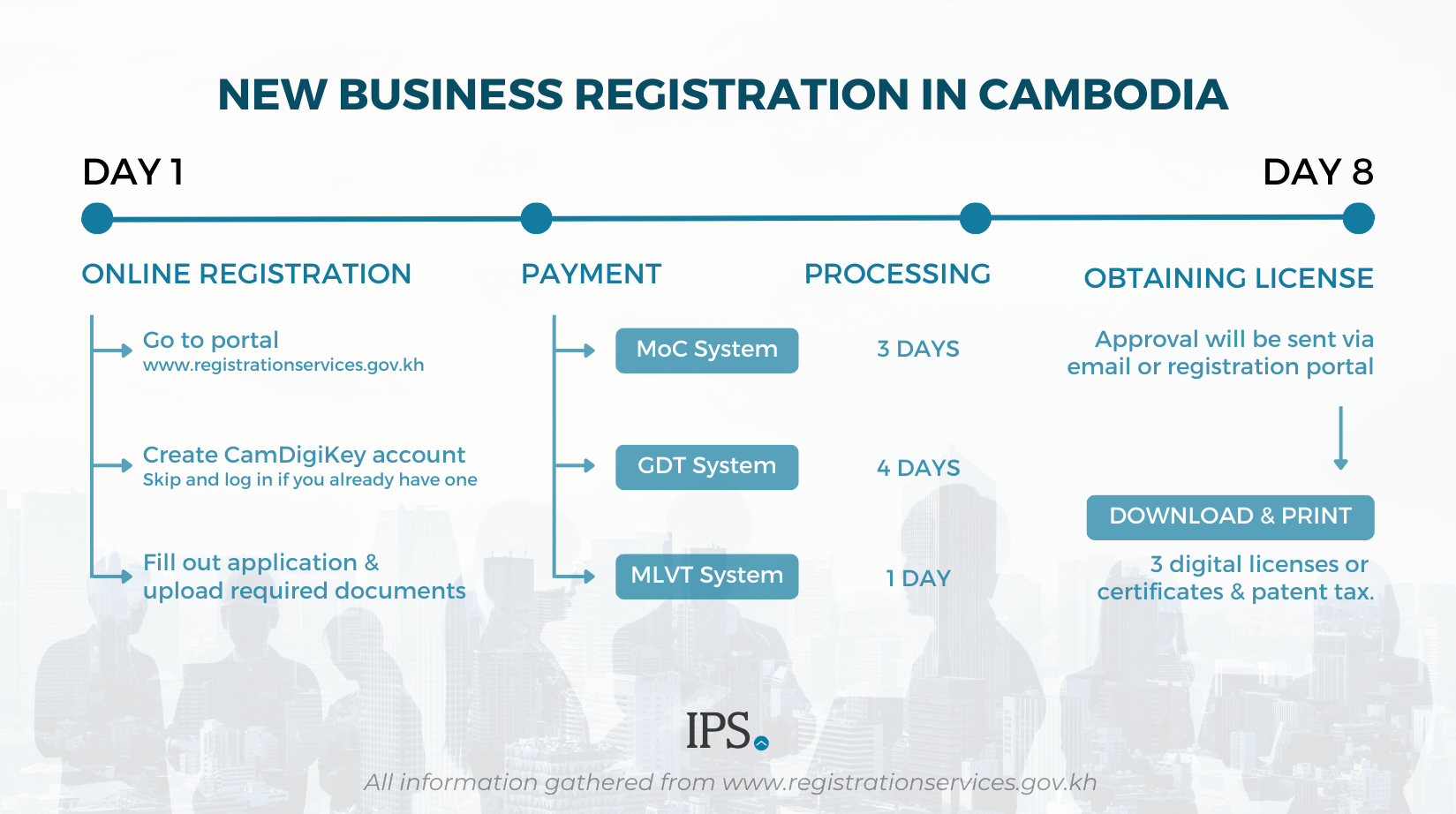

HOW TO REGISTER A COMPANY

Registering a business in Cambodia requires entrepreneurs to go through various ministries/institutions, mainly the Ministry of Commerce (MoC), General Department of Taxation (GDT), and the Ministry of Labour and Vocational Training (MLVT).

However, the New Business Registration via online portal (also known as single portal) provides an easier method of submitting applications to MoC, GDT and MLVT for registration of business in Cambodia. Unlike the old procedure which requires going repeatedly to physical offices of different ministries, the new business registration only requires entrepreneurs to compile all documents needed, submit and pay for the fees online—all within 8 working days to release the licenses or permits.

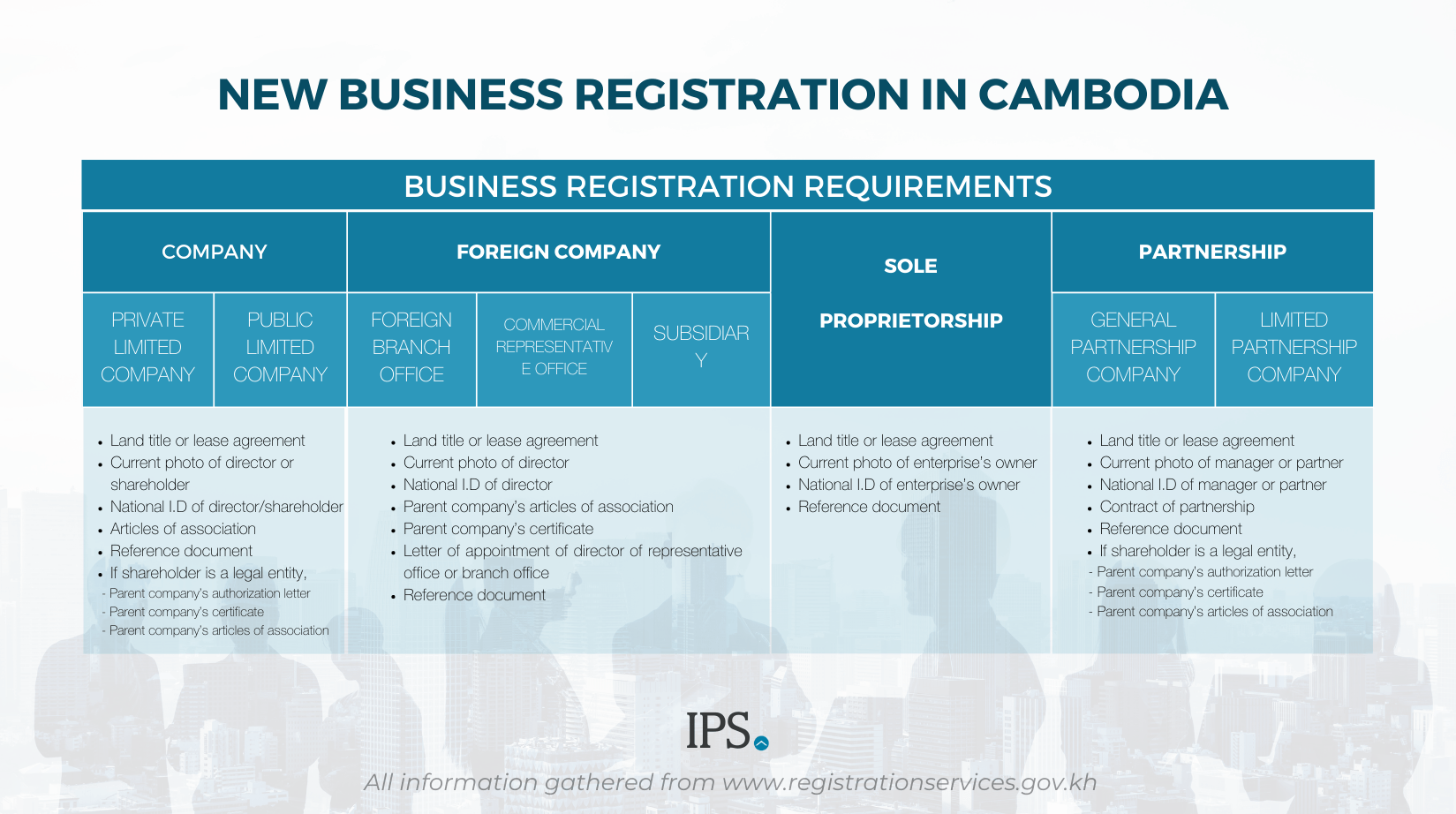

Depending on your business entity, the requirements may differ from one to the other.

Each form of business varies in documentation and eligibility requirements. It is worth noting that the more complex the business structure is, the more requirements and time-consuming it is to register a business in Cambodia.

Through the new business registration procedure, applicants must prepare scanned copies of the required documents to be attached (in pdf format or in .jpeg format for photos) and to be submitted through the online portal.

1. For Company

Business Registration requirements:

- Land title or lease agreement of the enterprise’s location*

- Current photo of no longer than 3 months of director, shareholder (if shareholder is a physical person) and/or representative (if shareholder is a legal entity) with white background*

- National identification card of director, shareholder (if shareholder is a physical person) and/or representative (if shareholder is a legal entity)*

- Articles of association*

- Reference document (can be a letter specifying an already-existed company’s permission to use a similar company name, special licenses and related documents)

- If shareholder is a legal entity,

– Parent company’s authorization letter*

– Parent company’s certificate*

– Parent company’s articles of association* - Authorization letter if the one who fills out the application is your representative

2. For Foreign Company

Business Registration requirements:

- Land title or lease agreement of the enterprise’s location*

- Current photo of no longer than 3 months of director with white background*

- National identification card of director*

- Parent company’s articles of association*

- Parent company’s certificate*

- Letter of appointment of director of representative office or branch office*

- Reference document (can be a letter specifying an already-existed company’s permission to use a similar company name, special licenses and related documents)

- Authorization letter if the one who fills out the application is your representative

3. For Sole Proprietorship

Business Registration requirements:

- Land title or lease agreement of the enterprise’s location*

- Current photo of no longer than 3 months of enterprise’s owner with white background*

- National identification card of enterprise’s owner*

- Reference document (can be a letter specifying an already-existed company’s permission to use a similar company name, special licenses and related documents)

- Authorization letter if the one who fills out the application is your representative

4. For Partnership Company

Business Registration requirements:

- Land title or lease agreement of the enterprise’s location*

- Current photo of no longer than 3 months of director, shareholder (if shareholder is a physical person) and/or representative (if shareholder is a legal entity) with white background*

- National identification card of manager, partner (if partner is a physical person) and/or representative (if partner is a legal entity*

- Contract of partnership*

- Reference document (can be a letter specifying an already-existed company’s permission to use a similar company name, special licenses and related documents)

- If partner is a legal entity,

– Parent company’s authorization letter

– Parent company’s certificate

– Parent company’s articles of association - Authorization letter if the one who fills out the application is your representative

Meanwhile, all forms of business entity are required to submit the following requirements for tax registration:

- Proof of paid property tax or property information of the enterprise

- QIP document (if applicable)

- Bank account information (must be provided in digital form within 15 working days after tax registration. Failure to do so would result in the revoke of the given certificates from GDT)

However, in some cases, your application may get returned for resubmission or may get rejected due to insufficient and/or illegible documents.

The returned application will indicate the requirement/s that you need to correct or complete. Resubmission of the application will not require applicants to pay for the second time. The review period will also restart from the date of resubmission.

Meanwhile, a rejected application will not be subject for refund. Before applying for a new application and paying for the fees, you must ensure that you know the reason for your rejected application to guarantee an approval.

For explanation surrounding your rejected application, please contact the Ministry/Institution that rejects your application via this hotline number 081 888 296.

Although all taxpayers are subject to the same annual and monthly tax obligations, each taxpayer is obliged to pay at different tax rates:

|

|

SMALL TAXPAYER |

MEDIUM TAXPAYER |

LARGE TAXPAYER |

|

Tax Registration Fee |

5 USD |

100 USD |

100 USD |

|

Registration Tax |

250 USD |

250 USD |

250 USD |

|

Patent Tax |

50 USD |

150 USD |

– if the annual turnover is less than 100,000 USD, the Patent Tax is 375 USD – if the annual turnover exceeds 2.5 million USD the Patent Tax will be 625 USD |

|

Prepayment of Profit Tax |

1% of monthly turnover inclusive of all taxes except VAT |

1% of monthly turnover inclusive of all taxes except VAT |

1% of monthly turnover inclusive of all taxes except VAT |

|

Withholding Tax |

Exempted from WHT obligation except WHT on rental of movable and immovable properties |

PAYMENT TO RESIDENT:

PAYMENT TO NON-RESIDENT:

|

|

|

Tax on Salary |

0% on Salary From 0 Riel – 1 300 000 riels 5% on Salary From 1 300 001 Riels – 2 000 000 Riels 10% on Salary From 2 000 001 Riels – 8 500 000 Riels 15% on Salary From 8 500 001 Riels – 12 500 000 Riels 10% on Salary From 12 500 001 riels – above |

||

|

Value Added Tax |

20% of the 10% VAT based on declared sales |

10% VAT based on declared sales |

10% VAT based on declared sales |

|

Minimum Tax |

N/A |

1% of annual turnover inclusive of all taxes except VAT |

1% of annual turnover inclusive of all taxes except VAT |

|

Tax on Accommodation |

2% on monthly declared income from accommodation |

2% on declared monthly income from accommodation |

2% on declared monthly income from accommodation |

|

Tax on Profit |

between 5% to 20% profit tax on all profit earned (all income minus all expense) |

I: between 5% to 20% profit tax on all profit earned (all income minus all expense) |

20% tax on all profit earned (all income minus all expense) the prepaid monthly profit tax payments made will be deducted from this required payment |

|

Financial Records |

Must obtain 3 years financial records |

Must obtain 10 years financial records |

Must obtain 10 years financial records |

|

Audit from Tax Department Office |

Rarely gets audited |

Randomly gets audited every 1 to 3 years |

Randomly gets audited every 1 to 3 years |

Note: If you’re a small taxpayer and grow into a medium taxpayer, the tax office will eventually advise you to change from small to medium taxpayer.

To ensure that the tax return is properly monitored and followed, a business must practice accounting and bookkeeping. Small taxpayers can use simplified accounting through excel sheets. Medium and large taxpayers require a more complex task which must comply to the Cambodian Accounting Standards.

Once a business has completed its tax registration, all taxpayers must return the following monthly and annual taxes.

1. ANNUAL TAXES

Each taxable year, the company’s profit and revenue is subject to taxation through either the tax on income or the minimum tax on every 31st of March, whichever tax is greater.

- Tax on Income (TOI)

The Tax on Income rate depends on what type of taxpayer you are.

|

BUSINESS TYPES |

TAX RATES |

|

Sole proprietorships and general partnerships |

Progressive rates of between 5% to 20%, based on Income earned

|

|

Small Taxpayers |

Progressive rates of between 5% to 20%, based on Income earned

|

|

Medium Taxpayers |

Subject to a rate of 20% |

|

Insurance companies relating to property or risk in Cambodia |

Subject to the type of insurance offered |

Profits are calculated by a company’s revenue minus deductible expenses. Expenses can be deducted if they are paid for or incurred in a tax year to carry on the business. Non-deductible expenses are those used for personal needs, entertainment and amusement, donations for charity, or anything that does not benefit the business.

2. MONTHLY TAXES

- Prepayment of Income Tax (PIT)

Every month, a taxpayer must make a prepayment of 1% of its monthly revenue, also referred to as turnover. PIT is essential in calculating the annual tax on income; whereas if the tax on income exceeds the prepayments made over the past year, an additional tax payment will be due, but if the prepayments exceed the tax on income, the minimum tax is applied with no additional payments required.

- Withholding Tax (WHT)

Taxpayers carrying on a business in Cambodia must withhold certain amounts from payments made to resident and non-resident taxpayers. The amounts withheld are remitted to the GDT.

Although withholding tax applies at all businesses, the tax rates depend on the type of payments and the residency of the recipient.

For payments made to a Cambodian resident, the rates are as follows:

|

PAYMENT TYPE |

TAX RATE |

|

Services provided by Cambodian residents not registered for tax |

15% |

|

Royalties |

15% |

|

Interest payments, except those paid by domestic banks |

15% |

|

Interest paid by a domestic bank on fixed-term deposits |

6% |

|

Interest paid by a domestic bank on non-fixed term deposits |

4% |

|

Rental payments, except for subleases to a rental business |

10% |

For payments made to non-residents, the rates apply:

|

PAYMENT TYPE |

TAX RATE |

|

Interest payments |

14% |

|

Royalties, rent and other property-related income |

14% |

|

Management and technical fees |

14% |

|

Dividends |

14% |

- Tax on Salary (TOS)

Residents – Monthly salary tax rates vary between 0% and 20% based upon the level of personal salary as shown in the table below. For resident employees, the tax to be paid is determined on the monthly taxable salary and must be withheld at these progressive rates:

|

Taxable Monthly Salary (USD) |

Salary Tax Rate |

Tax on Salary Calculation (USD) |

|

$0 – $325 |

0% |

$0 |

|

$325 – $500 |

5% |

(Salary x 5%) – $16.25 |

|

$500 – $2,125 |

10% |

(Salary x 10%) – $41.25 |

|

$2,125 – $3,125 |

15% |

(Salary x 15%) – $147.50 |

|

$3,125 + |

20% |

(Salary x 20%) – $303.75 |

Note: Exchange/Conversion rate of USD to KHR is at $1 USD = 4,000 KHR

Non-Residents – For non-residents, the tax to be paid is at a flat rate of 20% which constitutes a final tax.

- Value Added Tax (VAT)

VAT is applicable to the supply of goods and services used for production, trading and consumption in Cambodia (including goods imported into Cambodia).

The standard rate for activities not specifically detailed as VAT-exempt is 10%. Goods exported from Cambodia are subject to a zero-rate, and certain business activities are also considered exempt.

Under the Cambodian Labour Law, the employers must be aware of the following:

1. Hiring Employees

In hiring employees, the company must present a written employment contract (in English or Khmer) to the employee which should state:

- Employer and Employee full names

- Starting date

- Work location

- Compensation

- Job Title

- Job Responsibilities

- Terms on working during holiday/s

- Annual leave (vacation and sick leaves, and absences)

- Termination Provisions

- Other benefits

Other information can be indicated in the contract if they do not violate the legal requirements of the labour law.

2. Hiring a Foreigner

The Cambodian Labour law does not allow companies to hire a greater number of non-Cambodian employees; thereby allowing companies to hire only 10% of non-Cambodian national employees.

In hiring a non-Cambodian employee, the employer must require the employee to submit the following:

- Valid Passport

- Cambodian Visa

- Residence Permit

- Health Certificate

- Work Permit (processed and annually renewed by the employer through the Ministry of Labor and Vocational Training or MLVT)

2. Working Hours and Conditions

Cambodia requires employers to adhere to health and safety requirements in line with the International Labour Organization or ILO’s Promotional Framework for Occupational Safety and Health Convention (No. 187) 2006. Adherence to these standards is monitored by the Ministry of Labor.

- 8 Hour Working Day

- Working day must not exceed 10 Hours (including overtime)

- No more than 48 hours per week

- Minimum of 1 Day-Off per week

- Employees who work overtime are entitled to 150% of regular salary

- Employees who work overtime at night or weekly rest days are entitled to 200% of regular salary.

All garment factories must agree to be monitored by ILO’s ‘Better Factories Cambodia’ programme in order to obtain an export license.

4. Paying Employees

Salaries must be paid directly to employees, whether in cash, check, or bank transfer. Employees must be paid on the agreed date of salary payment, as indicated in the employment contract.

The most common term of salary payment is given twice a month, 50% every second week (usually 15th) and 50% every last week (usually 30th) of the month. Employees working on a commission basis should be paid every three months, at most.

Each paycheck is to be deducted with a salary tax, which then must be paid directly to the General Department of Taxation. Every paycheck, an employee must receive a pay stub which indicates the pay rate, tax deducted, overtime payment, used leave, remaining unused leave, and any bonuses or deductions.

5. Public Cambodian Holidays

An annual paid leave of 18 days applies to full-time employees, plus one additional day for every three continuous years of employment. A new employee only has the right to a paid leave after working for one year in a company. Any untaken leave must be paid-out at the end of the contract.

Every year, a list of paid holidays is indicated in a Prakas from the Ministry of Labour. As stated in Prakas, when a holiday falls on Sunday, the holiday takes place on the following Monday. When a business must operate even on a public holiday, affected employees are entitled to double pay.

6. Paid Leave

- Sick Leave is a leave of absence for the purpose of illness or other health reasons.

Provided the employee presented a doctor’s certification confirming the illness, employers must pay:

|

FOR THE FIRST MONTH |

FOR THE SECOND AND THIRD MONTH |

BEYOND THIRD MONTH |

|

100% of regular wages and attendance bonus |

60% of regular wages and attendance bonus |

Employers are not required to pay wages but must hold the position until the employee has been off work for a total of six months. Beyond that, employer is entitled to terminate the contract |

- Special Leave is a leave of absence for the purpose of family matters or personal reasons.

- Maternity Leave is a 90-day leave of absence that is only applicable for female employees that have served the company for one continuous year.

7. Terminating Employment

All employment contracts are subject to end either through employee’s resignation, termination, retirement, or death. Nevertheless, whether through resignation or termination, the procedures and payouts will depend on the contract signed by both parties.

Ten Categories of Occupations and Professions Prohibited for Foreigners

- Drivers of all kinds of vehicles as business such as two- and three-wheeled vehicles, tuktuk, four-wheeled motorcycles, van or truck.

- Sellers/vendors in public locations with all kinds of vehicles.

- Masseuse in public locations.

- Barbers, hairdressers and beautician

- Shoes sewer and polisher

- Tailor

- Street mechanic/Tire repairer

- Khmer souvenirs craftsman/Producer of Khmer Souvenir

- Instruments, statue artisan/Producer of Khmer Instruments, monk’s alms bowls or Buddhist statue

- Goldsmith and Jeweler/processor of precious stone

As you’re already aware of the business structures and registration procedures, you may find it really daunting to incorporate a business in Cambodia. Foreigners often struggle with the process especially when communicating with local authorities on Cambodian laws.

We assist all clients from finding the best real estate to helping them with every paperwork needed even after property purchase. As an expat-owned business itself, we have years of experience on setting up a business in Cambodia so we understand your needs way more than anyone else.

Frequently Asked Questions

What are the requirements for registering a business in Cambodia?

- A business name that is not already in use

- A registered office address in Cambodia

- Appointing a resident agent

- Filing the necessary paperwork with the Ministry of Commerce (MOC)

- Paying the required registration fees

How can I register a business in Cambodia online?

- The MOC offers an online business registration system called the One Portal. You can use this system to file the necessary paperwork and pay the required fees.

What are the benefits of registering a business in Cambodia?

- Protection of your intellectual property rights

- Access to government contracts

- The ability to hire foreign employees

- The ability to open a bank account

- The ability to import and export goods

What are the risks of not registering a business in Cambodia?

- You may be subject to fines, not be able to access government contracts, hire foreign employees, open a bank account or able to import and export goods.

What are the different types of businesses that can be registered in Cambodia?

- Sole proprietorships, Partnerships, Limited liability companies, Public limited companies, and Foreign companies are some of the business types that can be registered in Cambodia.

What are the steps involved in registering a business in Cambodia?

- Choose a business name, Choose a business structure, Find a registered office address,, Appoint a resident agent, File the necessary paperwork with the MOC, and Pay the required registration fees are some of the steps required to register a business in Cambodia.

How much does it cost to register a business in Cambodia?

- The registration fee for a business in Cambodia is $100 for a sole proprietorship or partnership, and $200 for a limited liability company.

How long does it take to register a business in Cambodia?

- The processing time for registering a business in Cambodia is typically 7-10 working days.

Where can I get more information about business registration in Cambodia?

- The MOC website has a wealth of information about business registration in Cambodia. You can also contact the MOC for more information.

What are the resources available to help me register my business in Cambodia?

- There are a number of resources available to help you register your business in Cambodia. These include the MOC website, the Cambodia Chamber of Commerce, and business registration consultants.

What licenses and permits are required to start a business in Cambodia?

- The licenses and permits required to start a business in Cambodia vary depending on the type of business. However, business registration certificates, tax registration certificates, import and export licenses, health and safety permit, work permit for foreign employees, and environmental permit are some of the most common licenses that you need.

Are there any special investment incentives for foreign investors in Cambodia?

- Property in Cambodia offers various investment incentives to attract foreign investors, such as tax holidays, tax exemptions, and special economic zones with preferential treatment.

How can I protect my intellectual property rights in Cambodia?

- To protect intellectual property rights in Cambodia, you can register trademarks, patents, and copyrights with the Ministry of Commerce. You can also register your intellectual property rights with the World Intellectual Property Organization (WIPO).

What are the labour regulations in Cambodia, and how can I hire local employees?

- The labour regulations in Cambodia are set out in the Labour Law of Cambodia. To hire local employees, you will need to comply with the Labour Law. This includes providing employees with a written contract, paying them at least the minimum wage, and providing them with social security benefits.

Can I hire foreign employees for my business in Cambodia?

- Yes, you can hire foreign employees for your business in Cambodia. However, there are some restrictions on the number of foreign employees you can hire. For example, you cannot hire more than 10% foreign employees in a company with 100 employees or more.

For further information or clarification, you may contact or visit the following: