Updated Land Values Across Phnom Penh

Phnom Penh’s property market remains steady in early 2025, with land values showing resilience across both central and suburban districts.

The IPS Cambodia Valuations Department has released updated figures on average land prices for the first quarter of 2025. Covering all fourteen districts, this data reflects verified transactions and appraisal insights gathered directly from on-ground market activity.

This latest report provides investors, developers, and property owners with a clear view of how land values are performing across Phnom Penh’s established hubs and fast-growing outer areas.

Market Overview

Land prices across Phnom Penh remain stable overall, reflecting cautious optimism and sustained confidence in the city’s long-term growth. Prime areas such as Daun Penh and Boeung Keng Kang continue to command the highest rates per square metre, supported by limited supply and strong commercial activity. Meanwhile, districts including Sen Sok, Russey Keo, and Chbar Ampov are showing steady movement as infrastructure projects and residential developments extend outward from the city centre.

Highlights:

- Highest land values: Daun Penh (up to $12,000/m²) and Boeung Keng Kang 1 (up to $9,000/m²)

- Emerging growth areas: Sen Sok, Chbar Ampov, and Russey Keo

- Most affordable zones: Kambol and Prek Pnov, with land still available below $300/m² in many communes

District Breakdown (Q1 2025)

Below are the verified average land-price ranges compiled by the IPS Valuations Department.

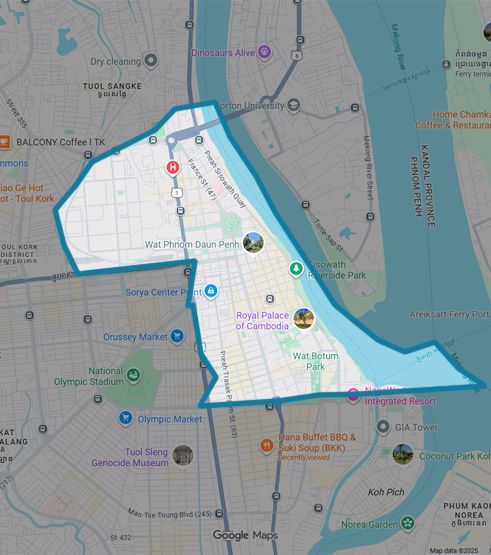

Daun Penh District

| Commune | Main Road ($/m²) | Sub Road ($/m²) |

| Boeung Raing | 5,000 – 7,000 | 2,700 – 4,500 |

| Chey Chumneas | 4,600 – 7,500 | 2,500 – 4,500 |

| Chaktomuk | 4,700 – 8,500 | 2,500 – 4,500 |

| Phsar Chas | 4,700 – 6,300 | 3,500 – 5,000 |

| Phsar Kandal (1–2) | 5,000 – 11,000 | 2,600 – 4,300 |

| Phsar Thmey (1–2) | 5,000 – 12,000 | 2,600 – 4,300 |

| Srah Chak | 3,300 – 5,300 | 2,000 – 3,700 |

| Wat Phnom | 4,000 – 5,500 | 2,500 – 4,100 |

Key insight: Daun Penh remains Phnom Penh’s commercial and heritage core, with strong demand around Central Market and Riverside.

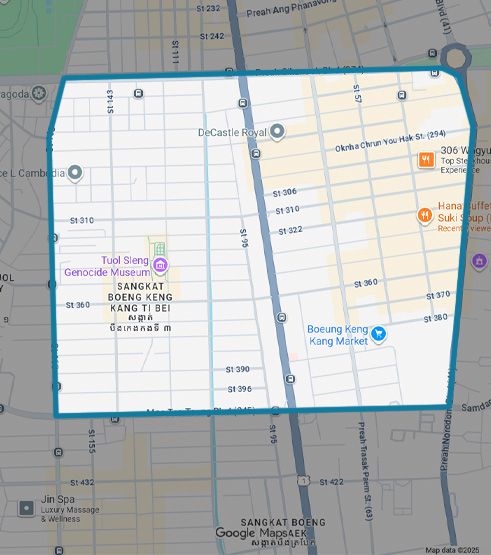

Boeung Keng Kang (BKK) District

| Commune | Main Road ($/m²) | Sub Road ($/m²) |

| BKK 1 | 5,000 – 9,000 | 4,500 – 5,000 |

| BKK 2 | 4,500 – 6,500 | 2,500 – 4,000 |

| BKK 3 | 4,500 – 6,500 | 2,500 – 4,000 |

| Olympic | 4,500 – 8,000 | 2,500 – 4,500 |

| Tumnup Teuk | 3,000 – 6,000 | 2,500 – 4,000 |

| Toul Svay Prey 1 – 2 | 4,000 – 7,100 | 2,500 – 3,900 |

Key insight: BKK 1 leads premium land values for mixed-use redevelopment and boutique residences.

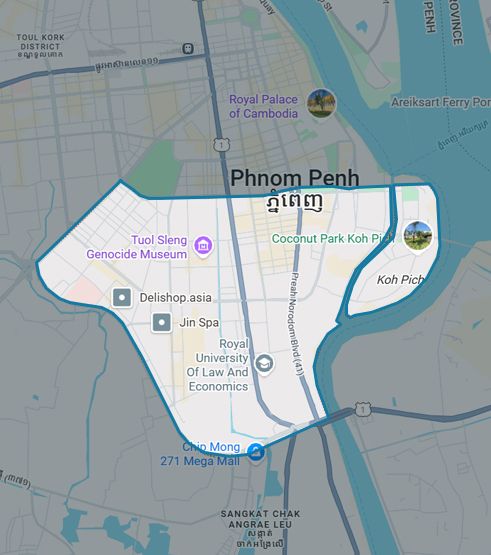

Chamkarmon District

| Commune | Main Road ($/m²) | Sub Road ($/m²) |

| Boeung Trabek | 3,200 – 5,000 | 1,800 – 3,000 |

| Phsar Doeum Thkov | 2,900 – 4,800 | 1,400 – 3,000 |

| Tonle Bassac | 3,700 – 6,900 | 2,300 – 3,800 |

| Toul Tumpoung 1 – 2 | 4,200 – 6,700 | 2,300 – 3,800 |

Key insight: Toul Tumpoung continues to thrive as a lifestyle and retail hub, with ongoing demand for mid-rise residential plots.

Toul Kork District

| Commune | Main Road ($/m²) | Sub Road ($/m²) |

| Boeung Kak 1 – 2 | 3,100 – 5,500 | 2,000 – 3,500 |

| Boeung Salang | 2,800 – 5,000 | 1,600 – 2,600 |

| Phsar Depo (1–3) | 3,300 – 5,100 | 1,900 – 3,000 |

| Teuk Laak (1–3) | 3,000 – 5,000 | 1,800 – 3,000 |

Key insight: Toul Kork remains one of the city’s most sought-after residential districts, with stable pricing and ongoing redevelopment.

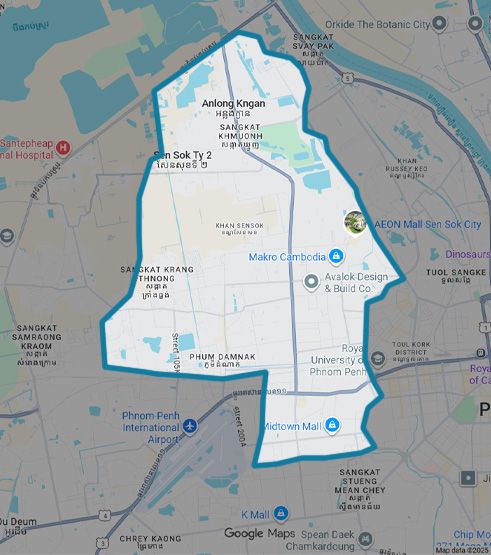

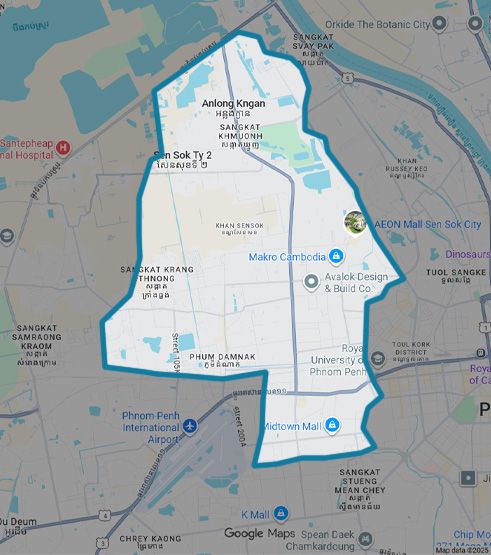

Sen Sok District

| Commune | Main Road ($/m²) | Sub Road ($/m²) |

| Khmuonh | 700 – 1,700 | 300 – 600 |

| Kork Khleang | 1,600 – 3,000 | 600 – 900 |

| O’Bek Kaom | 2,000 – 3,500 | 600 – 1,200 |

| Phnom Penh Thmey | 2,200 – 3,600 | 700 – 1,500 |

| Teuk Thla | 2,200 – 3,600 | 800 – 1,700 |

Key insight: Rapidly urbanizing with growing residential enclaves, Sen Sok continues to attract developers seeking affordable plots within reach of major roads.

Chbar Ampov District

| Commune | Main Road ($/m²) | Sub Road ($/m²) |

| Chbar Ampov 1 – 2 | 1,200 – 3,000 | 400 – 1,300 |

| Niroth | 1,100 – 2,500 | 400 – 1,100 |

| Veal Sbov | 600 – 1,500 | 200 – 400 |

| Prek Eng – Kbal Koh – Prek Pra | 200 – 1,000 | 100 – 500 |

Key insight: Improved connectivity and new housing projects are gradually increasing values in this riverside district.

Outer Districts Snapshot

| District | Main Road Range ($/m²) | Sub Road Range ($/m²) | Highlights |

| Russey Keo | 1,000 – 3,200 | 400 – 1,700 | Rising residential demand near National Road 5 |

| Prek Pnov | 50 – 1,300 | 20 – 490 | Low base, infrastructure potential |

| Dangkao | 100 – 2,300 | 30 – 600 | Large-scale industrial and housing plots |

| Kambol | 50 – 1,500 | 30 – 200 | Most affordable land near the outer ring road |

| Chroy Changva | 100 – 3,200 | 20 – 1,700 | Ongoing development along riverfront corridors |

Key Observations

- Central strength: Core districts like Daun Penh and BKK remain resilient, backed by strong commercial and residential demand.

- Suburban potential: Sen Sok, Russey Keo, and Chbar Ampov are benefiting from infrastructure expansion and new township projects.

- Price gaps remain wide: The difference between inner-city and outer-district land prices still exceeds 500 %, reflecting Phnom Penh’s uneven urban density.

- Investor sentiment: Land transactions are becoming more selective, prioritizing titled plots and accessible zones near established roads.

Methodology

All data in this report is compiled by the IPS Cambodia Valuations Department based on verified appraisals, transaction records, and on-site inspections conducted during the first quarter of 2025. Figures represent average ranges for typical main-road and sub-road land, exclusive of corner premiums or unique site adjustments.

Access the Full Breakdown

Want the full data set? Get the complete commune-by-commune breakdown of Phnom Penh’s land prices for Q1 2025 by submitting your email below.

About IPS Cambodia Valuations

IPS Cambodia is one of the country’s most trusted real-estate agencies and valuation firms. Our Valuations Department provides professional appraisals and market studies for banks, developers, and individual owners. With almost two decades of industry experience, IPS continues to deliver data-driven insights that support confident decision-making in Cambodia’s evolving property market.

📩 inquiry@ips-cambodia.com

📱 +855 77 959 861

→ Talk to an IPS Advisor