Buy vs. Rent – What Am I Ready For?

Should I buy a house in Cambodia now or should I wait? How will I know when I’m ready? Have you been asking these questions to yourself?

Everyone dreams of having their own home and by “own” meaning the property title is under your name. However, you might think that buying a house may not be the right path to take right now—at least not just yet.

So, how do you really determine whether or not you’re ready to buy or better to rent still?

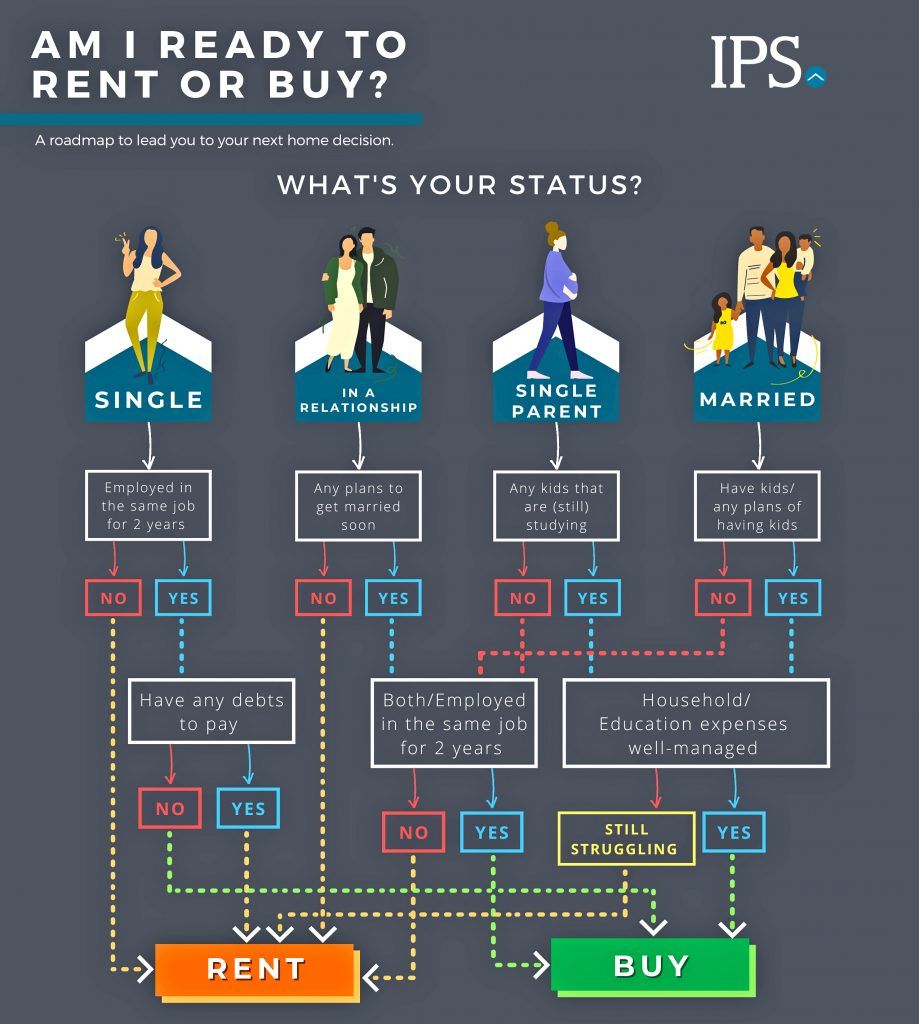

Here’s a road map that will lead you to your next home decision. This guide is focused on both the personal circumstances and financial stability. Because truth be told, selecting, buying and living in a house is as personal as it gets. However, despite your desire to buy a new home, outstretching your financial capabilities can upset your life considerably also.

What kind of lifestyle do you have or aspire to have?

Even when you’re financially stable enough to buy your own home, your lifestyle can determine your level of commitment especially when you’re single. For instance, the kind of job or business you’re in may require you to be designated to different cities at different times. Another factor is that you might be the kind of person who is still exploring what you really want in life, or the kind that travels around the world.

For this reason, an apartment or condominium unit for rent may be the path you should take for now. Renting gives you more flexibility and mobility to transfer between places until you finally decide to settle down in a neighborhood where you feel most at home.

Do you have an emergency fund/insurance that will not affect your mortgage?

Having an emergency fund or some kind of insurance gives people the confidence to invest in IPS as they have a special fund which can cover any of their household expenses, amortization payments, emergency incidents related to accidents or health-risks, and other unexpected costs.

People who are eyeing to buy their own homes are often holding back because of the fear of not being able to keep up with mortgages, getting their home loan defaulted and putting their home up for foreclosure due to endless expenses. So, if you have yet to invest in an insurance or emergency fund, it would be best to stick to renting for the meantime.

Are you not hiding from any debt?

If you have numerous pending debts in line, it may not be the ideal time to buy a house. Renting for a while will give you no pressure to clear all of those debts and other financial responsibilities as rental fees are often stable and affordable versus your income. It may increase a little in case of an economic crisis or a location upgrade, but it does not demand as much as a home loan. Nor does it accumulate interest.

However, if you have manageable debt, meaning you’re consistently paying your credit card in full and on time, and you’re getting close to clearing away those car payments and student loans, then you might be good to go on considering buying real estate.

In determining how much you might qualify in buying your own home via finance, mortgage companies mostly consider people who have no debts. But they may also consider someone who has debt yet is responsible to their payment timelines. All in all, if your current monthly payments are reasonable and you’re making them without issue, you may still be applicable for a home loan.

Do you have a lot of spare money and good rental history?

If you know you’re paying rent on time and you still have a little money to spare, then buying a house may be the next logical move. Banks or financial companies assess candidates based on their monthly expenses, debts and the remaining cash balance to either accumulate savings or invest into something such as a property.

If you’re consistently paying your rent on time and you’re putting a little into your savings each month, you can be a great candidate for home ownership.

Is your career a stable?

If you’ve got a good job and steady income, you’re well on your way to qualifying for the mortgage that can take you from a renter to owner. Bonus points, if you (and your partner) have stayed in your job for a long period.

More often than not, lenders will look at your employment history because they want to verify your ability to make the mortgage payment. Lenders want to limit the risk that they’re taking.

If you’ve recently started a new job or moved to a new industry, that’s not a problem as it’s not necessarily a deal breaker.

Do you want your money to go to a more reasonable investment?

Paying rental fee cuts a huge money on your monthly allowance but when you pay for your mortgage, you’re actually building equity in your home. If you want to invest in your future, real estate consistently increases value in time, and this can stretch out your investment further. It is like investing in yourself a little every month.

Do you want more freedom?

Are you getting a little tired of all the rules that come along with renting? No pets allowed, curfew hours, no loud music or parties. Maybe you really want a space where you can do what you want, when you want, and the freedom to design your home.

If you’ve been renting your whole life and you know you’ve been paying rents on time, then it’s time to move to a permanent place you can call your own. When it’s your house it’s your rules, so you have the freedom to do anything to your home.

Are you still struggling financially?

You have a stable career and you’ve been wanting to have a place of your own but you’re still struggling with all of your expenses right now. Buying a house is not just an emotional decision, it’s a financial decision. If you’re supporting a big family or you still have a lot of tuition fee payments that can put your home loan at risk, buying a house may not be a good option right now.

Are you planning to start your family soon?

Gearing yourself up for a life transition such as having a family soon is one factor that may make you decide to finally buy your own home. Whether you’ve already got a few kids in toe, or you’re just starting to think about what your family is going to look like, buying a home gives you an active say in the school or district your kids will attend or and the type of lifestyle they will have when growing up.

There you have it! If you have assessed your qualifications based on the roadmap above and it seems like home ownership is the right move, it might be the perfect time to take the next step.

If you’re considering moving today and you’re looking for the right property within a neighborhood that suits your lifestyle best, the helpful team at IPS Cambodia would be happy to be a part of your journey.

ទាក់ទងមកកាន់យើង and we’ll connect you to our professional agents.