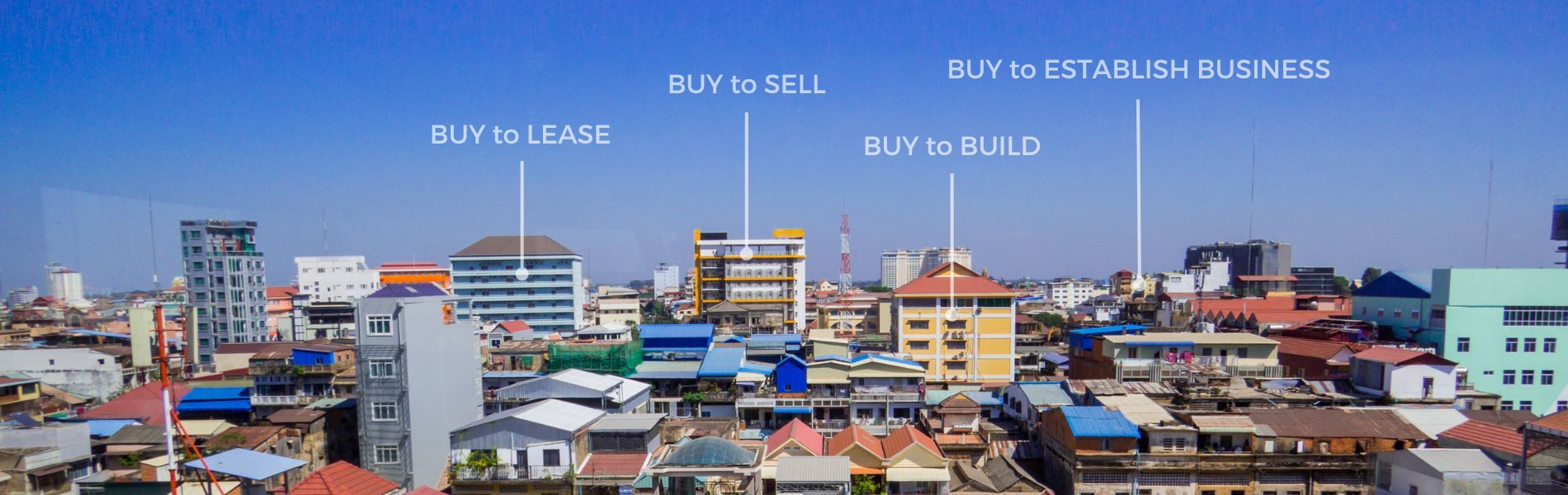

Are you seeking the next lucrative real estate investment opportunity? With its strategic location in Southeast Asia, a stable economy, and a young, growing population, Cambodia presents a wealth of opportunities for those looking to diversify their investment portfolios.

Cambodia’s real estate market is increasingly alluring for foreign investors, thanks to its relatively low entry costs, impressive rental yields, and the potential for substantial capital appreciation.

Furthermore, the government’s pro-investment policies, including the allowance of foreign ownership of condominium units and tax incentives for specific investment schemes, have made it more accessible for international investors to enter the market.

To help you make the most of this opportunity, we’ve outlined some key points to remember when investing in Cambodia’s real estate market.

1. Buy to Sell

One of the most popular investment strategies in the Cambodian real estate market is buying properties with the intention of selling them at a higher price in the future. This approach is particularly attractive to investors looking for significant capital appreciation over time.

Purchasing Property for Capital Appreciation

Investing in properties for capital appreciation means buying real estate with the expectation that its value will increase over time, yielding substantial returns upon sale. This strategy requires a thorough understanding of the market trends, economic indicators, and potential growth factors that can contribute to property value appreciation in Cambodia.

Identifying Prime Locations and Property Types

To maximize capital appreciation, it’s crucial to identify prime locations and property types that are in high demand and have growth potential. Prime locations in Cambodia include major cities like Phnom Penh, Siem Reap, and Sihanoukville.

Property types that tend to appreciate in value include condominiums, landed properties, and commercial spaces in high-growth areas. Thorough market research and analysis can help investors pinpoint the most suitable properties for their investment goals.

Timing the Market for Optimal Returns

Investors should monitor market trends, economic indicators, and government policies to identify the best time to buy and sell properties. Some factors to consider include interest rates, currency fluctuations, and the overall economic climate in Cambodia.

2. Buy to Lease Out

Another promising investment strategy in the Cambodian real estate market is purchasing properties with the intention of leasing them out to generate consistent rental income. This approach is ideal for investors who seek regular cash flow and long-term property appreciation.

Understanding Rental Yields in Cambodia

Rental yield is the annual rental income expressed as a percentage of the property’s purchase price.

In Cambodia, rental yields can vary depending on property type, location, and market conditions. However, they generally range from 5% to 8% for residential properties and can go higher for commercial properties.

Selecting the Right Property for Leasing

Choosing the right property to lease out is essential for maximizing rental income and ensuring a steady cash flow.

Factors to consider when selecting a property include:

- Location: Properties in prime locations, such as city centers and popular tourist destinations, tend to attract higher rental fees and have better occupancy rates.

- Property Type: Different property types, such as condominiums, apartments, and landed properties, cater to different tenant segments and have varying rental yields. Investors should choose a property type that aligns with their target tenant market and investment objectives.

- Amenities and Facilities: Properties with modern amenities, such as gyms, swimming pools, and 24-hour security, are more appealing to tenants and can command higher rental prices.

Managing Tenant Relationships and Property Maintenance

Investing in rental properties also involves managing tenant relationships and ensuring proper property maintenance. Effective tenant management includes conducting thorough tenant screening, setting clear lease agreements, and addressing tenant concerns promptly.

Regular property maintenance not only keeps the property in excellent condition but also helps retain and attract quality tenants. Investors can choose to handle these responsibilities themselves or hire a professional property management company to streamline the process and ensure a hassle-free experience.

3. Rent to Sublease

Subleasing, also known as subletting, is a strategy where a tenant rents out a property they have leased to a third party, known as a subtenant. This approach can be a viable option for investors in Cambodia who wish to generate additional income without purchasing a property.

Advantages of Subleasing in Cambodia

- Lower upfront investment: Subleasing requires less initial capital compared to purchasing a property, making it an attractive option for investors with limited funds.

- Flexibility: Subleasing agreements tend to be shorter-term compared to traditional lease contracts, offering flexibility for both the tenant and subtenant.

- Increased rental income: If the rental market is favorable, subleasing can provide an opportunity for tenants to generate additional income by charging a higher rent to the subtenant compared to their original lease agreement.

Legal Considerations and Regulations

Before engaging in subleasing, it is essential to understand the legal considerations and regulations in Cambodia.

- Lease agreement: Investors should review their lease agreement to ensure that subleasing is permitted. Some lease agreements may explicitly prohibit subletting or require the landlord’s permission before subletting the property.

- Tenant responsibilities: The original tenant remains legally responsible for the property, including rent payments to the landlord and any damages caused by the subtenant.

- Sublease agreement: It is crucial to have a written sublease agreement between the tenant and subtenant, outlining the terms and conditions, rental fees, and duration of the sublease.

4. Buy or Rent to Establish a Business

Establishing a business in Cambodia requires a strategic approach to selecting the right commercial property and understanding the local market and business regulations.

When considering whether to buy or rent a commercial property for your business, the following factors should be taken into account:

- Location: Choose a strategic location with high visibility, accessibility, and proximity to your target customers. Factors such as traffic patterns, parking availability, and nearby amenities should also be considered.

- Property type: Depending on the nature of your business, you may require a retail space, an office, a warehouse, or industrial property. Ensure the property meets your business’s specific needs in terms of size, layout, and infrastructure.

- Budget: Evaluate your budget and financial capacity to determine whether buying or renting is more feasible. Purchasing a property requires a more significant upfront investment, while renting offers flexibility and lower initial costs.

Assessing Local Market Demand and Competition

Before establishing a business in Cambodia, it is vital to conduct thorough market research to assess local demand and competition.

- Target market: Identify the demographics and preferences of your target customers, and determine whether there is sufficient demand for your products or services in the selected location.

- Competitor analysis: Analyze the strengths and weaknesses of your competitors, and identify potential opportunities to differentiate your business and gain a competitive edge.

- Market trends: Keep up-to-date with local market trends and economic indicators to make informed decisions about your business strategy and growth potential.

Business Licensing and Regulations

Establishing a business in Cambodia involves complying with local licensing requirements and regulations, which include registering your business with relevant Cambodian authorities, such as the Ministry of Commerce, to obtain a business registration certificate.

Additionally, businesses must ensure they are registered with the General Department of Taxation and adhere to local tax regulations, including filing tax returns and paying applicable taxes.

Depending on the nature of your business, you may also require additional licenses or permits from relevant ministries or government agencies; for instance, businesses in the food and beverage industry may need approval from the Ministry of Health.

5. Buy and Develop to Sell or Lease Out

Property development in Cambodia presents numerous possibilities for growth and substantial returns on investment. Here, we will delve into the opportunities within property development, the management of development projects and partnerships, and how to optimize returns through strategic sales or leasing practices.

Overseeing Development Projects and Collaborations

Successful property development necessitates cooperation with various stakeholders, including architects, contractors, and government agencies. Efficient project management and partnerships are crucial to ensuring the success of any development endeavor.

- Comprehensive Planning: Collaborate with skilled architects and designers to create a viable and appealing plan that caters to market needs and adheres to local building codes and regulations.

- Selecting Contractors: Opt for reputable and dependable contractors with a history of delivering high-quality results within the specified time and budget constraints.

- Compliance with Regulations: Guarantee that your development project follows all required permits, licenses, and regulations, including obtaining approval from the appropriate government entities.

- Ongoing Supervision: Consistently oversee your development project’s progress, promptly addressing any complications or setbacks to reduce costs and guarantee a timely completion.

Boosting Returns through Tactical Sales or Leasing

To enhance returns from your property development, it is essential to adopt tactical strategies when selling or leasing your finished properties.

Begin with market placement, positioning your property strategically to target the ideal audience while setting competitive pricing based on comprehensive market research and analysis. Implement a well-rounded sales and marketing strategy to advertise your property, using channels like online platforms, local advertisements, and real estate agents.

For those leasing properties, ensure transparent lease agreements and terms, and consider partnering with property management firms for efficient and professional handling of your properties.

Lastly, monitor market conditions and trends closely to identify the most opportune moment to sell or lease your properties, maximizing returns and minimizing vacancy rates.

6. Buy to Renovate, to Sell, or Lease Out

Investing in renovation projects can yield substantial returns when executed correctly. Investors should focus on the long-term value of property and not be tempted by short-term gains. Investing in a good location is essential for making a profit.

Identifying Properties with Renovation Potential

When identifying properties with renovation potential, focus on location, property condition, and market analysis. Seek properties in desirable neighborhoods or areas with growth potential, where infrastructure improvements, increased demand, or attractive amenities are evident.

Opt for properties that need renovations but possess a solid foundation and structural integrity, avoiding those with severe issues that might be expensive and time-consuming to address.

Lastly, conduct thorough research on local property trends to pinpoint the types of renovations that generally result in high returns in the area.

Planning and Executing Renovation Projects

When planning and executing renovation projects, several crucial factors come into play, such as the following:

- Setting a budget

- Developing a renovation plan

- Hiring a reliable team

- Monitoring progress

Marketing Renovated Properties for Sale or Lease

- Staging and presentation: Present the renovated property in the best possible light, using professional staging and photography to showcase its features and improvements.

- Pricing strategy: Set a competitive price for the renovated property, taking into account the costs of renovation, market trends, and comparable properties in the area.

- Sales and marketing campaign: Develop a tailored sales and marketing campaign to target potential buyers or tenants, utilizing various channels such as online listings, print advertisements, and real estate agents.

- Negotiation and closing: Engage with interested parties and negotiate the best possible terms for the sale or lease, ensuring that all legal requirements and paperwork are completed accurately and efficiently.

Tips for Successful Real Estate Investing in Cambodia

To succeed in real estate investing in Cambodia, several tips should be taken into consideration.

First, conduct thorough research on the Cambodian property market, regulations, and trends to make informed decisions. Focusing on properties in high-growth areas, where infrastructure developments and attractive amenities drive demand, is essential for maximizing returns.

Second, diversify your investment portfolio to minimize risks and maximize returns across various property types and locations. Collaborate with local real estate professionals to access their knowledge and expertise.

Third, perform comprehensive due diligence on property titles, zoning regulations, and potential legal issues before committing to any investment. By being thorough in your research and investigation, you can avoid potential pitfalls and protect your investment.

Lastly, adopt a long-term perspective when investing in real estate, as property markets can be cyclical and require patience to achieve optimal returns.

By applying these strategies and tips, investors can successfully navigate the Cambodian real estate market, capitalize on opportunities, and build a profitable investment portfolio.

Want to invest in real estate in Cambodia? Learn the best property investments today! Contact us to connect you with our property experts.