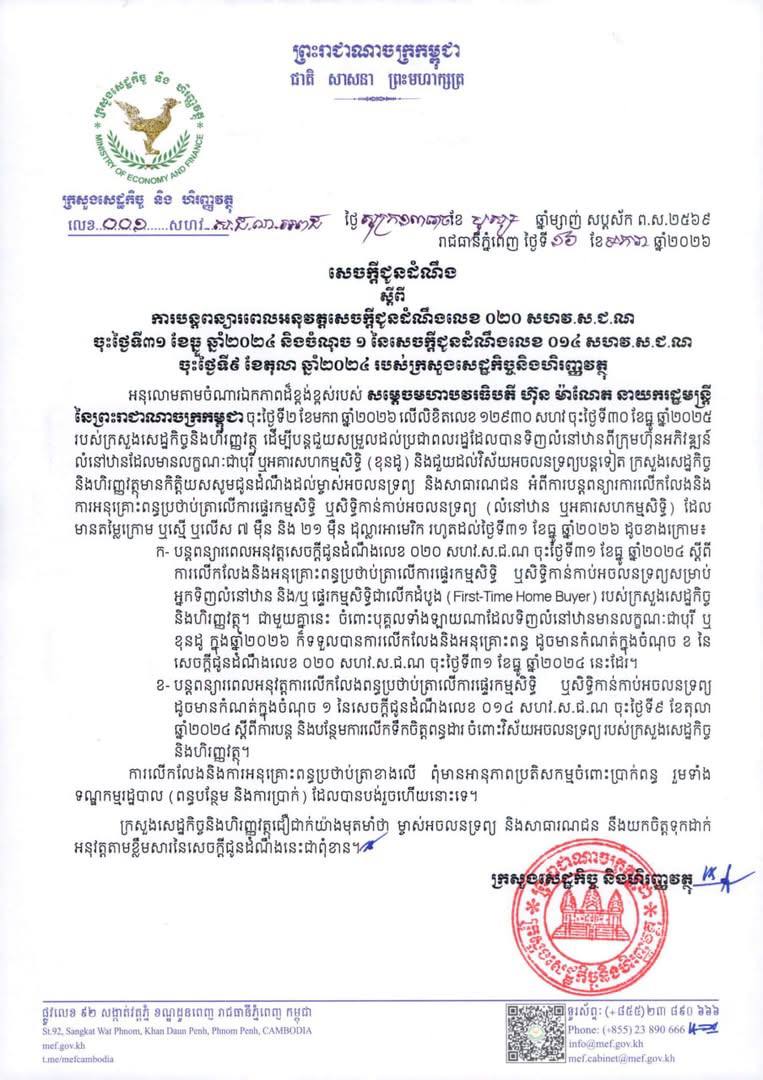

The Ministry of Economy and Finance (MEF) recently issued a new notification (dated January 16, 2026) regarding the extension of tax incentives for the real estate sector. Following the recommendations of Prime Minister Hun Manet, this move is designed to alleviate the financial burden on citizens and stimulate growth within the property market through the end of 2026.

At IPS Cambodia, we want to ensure you are fully informed about how these exemptions might apply to your next property investment. Here is a breakdown of what you need to know:

Extension of Stamp Duty Tax Exemptions

The Cambodian government has officially extended the validity of previous tax incentive measures until December 31, 2026. Specifically, this applies to the 4% Stamp Duty (Transfer Tax) typically paid during the transfer of property ownership.

To qualify for this exemption, there are several specific criteria that both the property and the buyer must meet:

- Property Type: The exemption is strictly for residential properties located within a Borey (gated community) or a registered Condominium project.

- Registered Developers: The property must be purchased directly from a developer that is officially registered with the Real Estate and Pawnshop Regulator or the Provincial Department of Economy and Finance (DEFE).

- Property Value: The exemption applies to properties with a value of $210,000 or less. (Click to see properties under $210,000 at IPS)

- First-Time Buyer Status: This incentive is specifically targeted at first-time buyers. To qualify, the applicant must not currently own any other registered property in Cambodia.

- Required Documentation: During the ownership transfer process, the buyer must submit the original Sale and Purchase Agreement (SPA) that reflects the actual market value of the property to the tax administration.

Read more: Cambodia Postpones Capital Gains Tax (CGT) on Real Estate Until 2027

This extension is a significant win for those looking to enter the property market in 2026. By removing the 4% transfer tax on homes under $210,000, the government is making homeownership significantly more accessible for the Cambodian middle class and first-time local buyers.

At IPS Cambodia , we guide both local and international property owners through every step of buying and selling . That includes helping you understand property registration and various taxes. Our team can help you estimate your tax, prepare your documents, and plan your sales with confidence.

📩 Need help selling your property or knowing whether you’re qualified for the exemption? Contact your favorite IPS agent today!