How Does IPS Conduct Property Valuation in Cambodia

Property Valuation or real estate appraisal is the process that determines the market value of a particular land, house, business or commercial space. This process helps you understand how much your property is worth. It looks at several factors including location, age and condition, demand and scarcity, ease of transfer and usage.

Property Price Vs Market Value

There is a difference between how much the property actually is (market value) and how much someone is willing to pay for that specific property (property price). These differences occur when investors are willing to pay a higher price than its market value due to factors such as location and future worth.

The owner’s relationship with the buyer, need for a faster sale and the owner’s ignorance of the actual value of the property are some reasons why a property is sold at a lesser price.

This is the reason why a fair, impartial property valuation is crucial to determine a property’s actual market value and future worth. Arriving at an accurate price and being able to justify that valuation with supporting facts is the specialization of the real estate professionals at IPS.

Importance Of Property Valuation

The following are the uses of the comprehensive reports obtained through respected real estate companies in Cambodia such as IPS.

- Selling the property – A properly valued property gives you more bargaining power and the best selling price to offer buyers.

- Real Estate Investments – You need due diligence when buying a house or a piece of land. Employing the services of a respected agency will ensure that you get the best value for your money.

- Tax Compliance – Although the property is assessed by the cadaster office to determine the property taxes that need to be paid, it is important that you have a certificate declaring the actual market value of your property.

- Correct Rental Rates – Proper valuation, based on the qualities and amenities of a property, determines the correct lease or rental cost.

- Division of Property Rights – Family members need the correct market value to distribute property rights in case of inheritance, matrimonial and litigation settlements.

- House Mortgages and Bank Loans – Banks require a property valuation certificate to guarantee the loan or mortgage of property.

- Insurance – Professional Valuers give the accurate market value of the property for purposes of insurance coverage and claims.

- Value-added recommendation – The Property Valuation report gives the owners a clearer perspective of the market value of his property. It gives a recommendation on the improvements needed to increase its value in time for the next valuation.

What Does A Property Valuer Do?

A property valuer inspects the property itself and its surrounding properties to take detailed notes on construction materials, fixtures and fittings, future marketability and property condition. They measure the land & building, calculate the floor area. They also check for improvements that can increase the property’s market value.

In order to arrive at an accurate valuation, a property valuer considers the following factors:

- Demand, desire or need for ownership considering the financial means of the buyer

- The ability of the property to satisfy future owners’ needs

- Uniqueness or Scarcity of similar properties in the real estate market

- The ease of transfer from current to the future owner of the property.

Property Valuation At IPS – Step By Step Process

- Instruction made from the client – 85% of the company’s clients are banks that require an objective valuation. They use this to know how much financing they can approve mortgages and loans. The rest of our clients are property owners that want to know their property’s worth and what improvements they need to do to increase its value.

- The Banker/owner provides the required documents – The valuation starts once documents pertaining to the property or business is provided. This ensures rightful ownership of the subject property.

- Condominium – Constructions cost such as invoices and receipts (developer), Master Plan, Construction permit, Patent

- Land – Title and ID card of the property owner

- Residential Buildings (not owned by Developer) – Title and ID card of the property owner

- Any Company Property – Company Registration Permit, Constructions cost such as invoices and receipts (developer), Master Plan, Construction Permit, Patent

- Business – Income Tax statement, Certificate of Registration, Business Costs, Rental / Lease Agreements, Inventory lease, and Inventory cost

- Inspection arrangement – the Physical Site Inspection and Authority Check of the property is done to determine factors affecting the market value.

- Market Value Analysis

- Report Write up – there are 3 reports that sum up the valuation. It includes an Executive Report, Valuation Summary Report and a Valuation Certificate

- Report Check – The Valuation Manager and the Head of Valuation checks the completed report

- Report delivery – The requesting party or bank use the submitted report for mortgage, loan approvals, division of properties and others.

Methods Of Valuation

Market Value Analysis is the process of arriving at an accurate value of the property using proven methodologies. At IPS, we use 4 methods in determining property value.

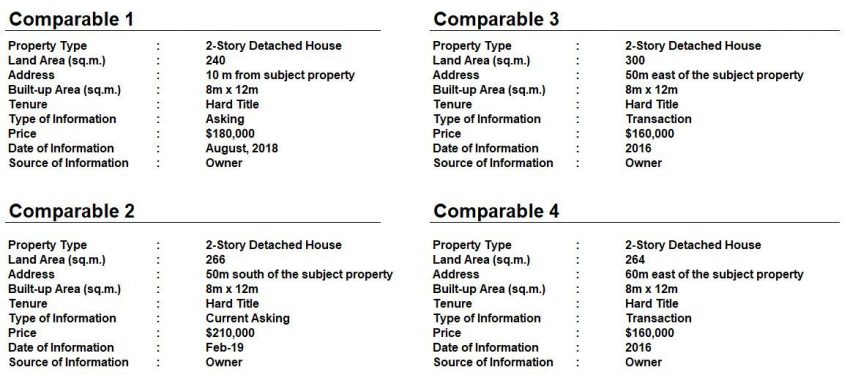

- Comparison Method – This approach considers the sales of similar properties and related market data.

- It establishes a market value estimated by adjustments made for differences in factors like time element, location, frontage, shape, size, lot type, tenure, and other relevant factors.

- Comparable properties are those of similar size, relevant conditions, and location. Market value also considers the trend of prices.

- If prices are trending upward, it is advantageous to price the property slightly above the last sale of a comparable property.

At IPS, the standard is to compare 4 other similar properties. We compare the market value of the same type, the same location, a similar area in square meter, and the number of bathrooms and bedrooms to determine the benchmark of a property’s value. Similar properties sold within the last six months is also another aspect to consider.

We make adjustments on the market value for improvements like a new roof or septic system, landscaping, new windows, renovated kitchens or bathrooms.

- Cost Method – This approach considers the possibility that, as a substitute for the purchase of a given property, one could construct another property that is either a replica of the original or could offer comparable utility.

- This approach involves estimating the depreciation for older or less functional properties. The estimated cost of a new replacement is likely to exceed the price for the subject property.

Land Value + (Building Cost New – Depreciation)

Building Dep.: 1% – 2% pa

- Investment Method – This approach considers the net income that a property might generate, typically in the form of rent. An appropriate yield at a suitable target rate of return capitalizes the income.

Formula: Net Annual Income ÷ Capitalization Rate (Cap rate) = Market Value

- Residual Method – This method estimates land value remaining from the value of the completed development (Gross Development Value) minus the cost of building the property (Gross Development Cost) and the Developer’s Profit requirement.

Current Property Value = Gross Development Value–(Gross development costs)where Gross development costs = cost of construction, professional fees, legal fees, contingency and developer’s profits

Types Of Reports Submitted By IPS

- Comprehensive report – A comprehensive report will include active, pending and sold listings, as well as off-market data. This report will show the highest and most competitive price of the property.

- This report considers the land size in square footage, available rooms and corresponding sizes, property taxes, age, and uniqueness. They also include location and amenities that may boost the profitability of the property being valued.

- Valuation Summary Report – this report includes summative information such as rates, size of the land/building, physical details, the condition of the property, issues that need addressing and comparative sale of similar properties in the area.

- Valuation Certificate – this document shows the general information of the owner, Total Fair Market Value of the Property and Total Distress Value. The certificate includes an undertaking that states “an impartial party, with no direct or indirect interest on the property” did the valuation .

How Do We Value A Property?

There are different ways of deriving the value of a specific property. The most common method being used is the comparison method. It checks the value of 4 similar properties and arrives at fair market value.

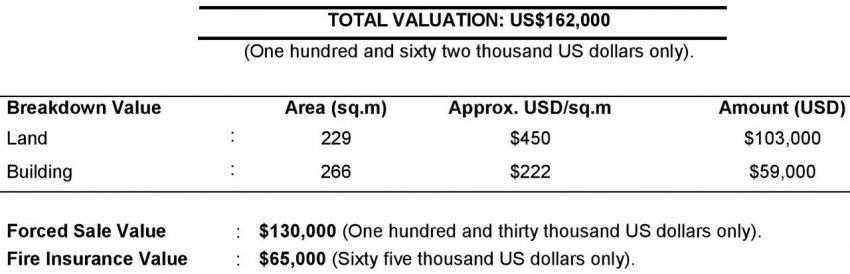

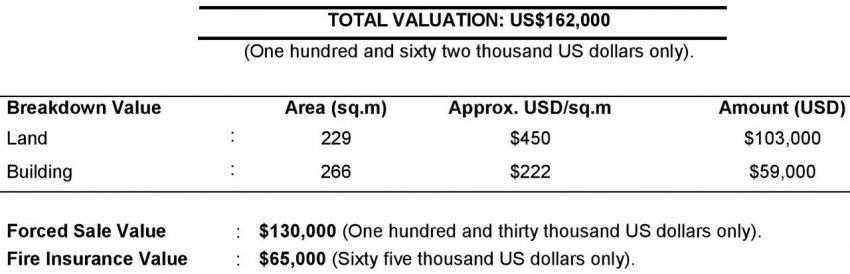

Case Study Sample 1 – Land For Sale

Purpose of Valuation : To determine the fair market value of the land prior to selling.

Property Type: 2-story detached house erected in a land located in Chbar Ampov

Location: Land is along a paved road ~200 meters southeast of Prek Eng Commune Hall

Land Area: 229 sq.m.

Built-up Area: 266 sq.m.

Current Status and Opinion

The highest and best use of this property is for residential use.

The arrived market value is for the current situation of the subject property which is bare land together with improvements and current building cost. However, the value will increase in the event that the subject property is converted into the best use mentioned above.

Another locality basis in terms of buying and selling land in the vicinity is “Per Square Metre". Normally, bare land in the vicinity is in the range of $100 – $500 per sq.m., as checked with the local authority of the commune where the land is located.

In determining the price of the land per sq.m., we use a combination of 2-3 methods. Aside from the comparative analysis, we also get the cost of improvement minus the depreciation value percentage per year. Other factors in the calculation are adjustments for potential growth in the area, road access, shape, lot type, title, terrain, and others.

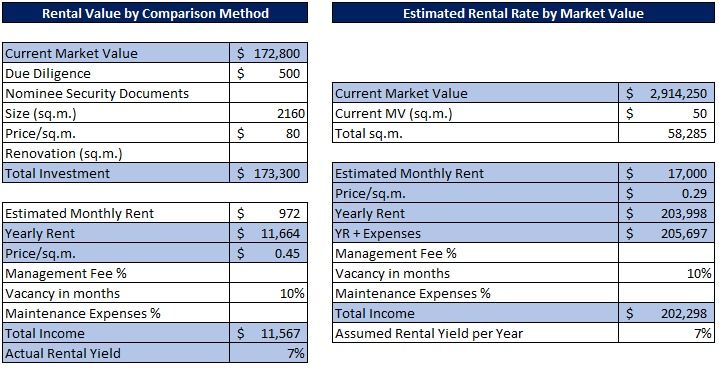

Case Study Sample 2 – Land For Rent

Purpose: To determine the fair market rental value of the land.

Property Type: Vacant Land

Location: Land is located approximately 350 meters south of Phum Baitang Resort

Land Area: 58,285 sq.m.

In determining the market rental value of the land, we compared a similar rental price of lands in the area and derived a fair rental yield percentage per month.

NOTE: These are sample valuation case reports and does not show full details on how a property is valued. Different factors affect the market value of a subject property. Our team of experts gives a recommendation only after full inspection and analysis. 10% of the biggest banks in the country trust our recommendation.

How Is Valuation In IPS Different From Other Real Estate Companies?

- Adoption of the International valuation standard (IVS)

- Internally-built Property Database System

- Use of Actual Transaction (Recent Sale) in our market value analysis

- The Valuation Committee comprising of the Country Manager, Head of Valuation, Valuation Manager and Senior Valuer approves the Market Value included in the report.

- Market Commentary included in the report

- 3 types of reporting material including a Comprehensive Report, Valuation Executive Report and Valuation Certificate

- Crackdown on corruption. Once found, immediate termination awaits the person(s) involved in the case

- Service Level Agreement (SLA) for our bank partners

- IPS Brand – Honesty, professionalism & integrity

When it comes to property valuation, IPS is the trusted company by the majority of the banks in Cambodia . Real estate valuation is the heart of IPS’ professional services. IPS delivers a comprehensive, impartial report customized to address each client’s specific needs. Our competencies run the breath of standard properties such as office, retail, residential, industrial and agricultural property types.

At IPS-Cambodia, our valuation services are designed to deliver insight into a property’s fundamentals, its competitors and the overall market dynamics affecting current and future. IPS believes that Valuation is a strategic asset for investors and owners alike if reported accurately , promptly and factors in issues specific to the Cambodian Market .

Related Articles

Japanese Quality Coming Soon: G.A.T.O Tower – A New Landmark of Luxury in Phnom Penh’s BKK1

Phnom Penh is preparing for a monumental shift in its urban landscape with the announcement of G.A.T.O Tower , a 65-story mixed-use development set to dominate the BKK1 skyline . Developed by MIRAKU Capital & Development Co., Ltd. , this project is a sophisticated collaboration between Japanese and Cambodian investors, merging world-class Japanese quality standards with the vibrant local lifestyle. As a landmark project, it promises to redefine luxury living for residents and offer a premier destination for international travelers.

Cambodia’s Capital Gains Tax on Real Estate Explained (2026 Update)

From January 2026, profits from property sales in Cambodia will be subject to CGT. This guide explains what it means for property owners.

Navigating Complex Land Acquisition in Cambodia: A Case Study by IPS

This transaction, characterized by its confidentiality and complexity, demonstrates IPS’s unparalleled expertise and strategic approach to real estate deals.