The 2025–2026 Phnom Penh Condo Completion List Buyers Have Been Waiting For

Phnom Penh is entering one of its biggest handover cycles in years. Several major off-plan developments are reaching completion between late 2025 and 2026, giving buyers something the market hasn’t offered in a long time: new, ready-to-move-in units from established developers across the city’s fastest-growing districts.

At the same time, Cambodia’s Capital Gains Tax (CGT) on Real Estate begins in January 2026, reshaping buyer behavior. Investors are now shifting away from quick flips and toward long-term strategies driven by rental performance and credible management. Despite concerns about supply, Phnom Penh continues to deliver rental yields in the 6.5 to 8 percent range, supported by a large expat population and strong demand for modern, fully managed homes.

Developers are responding with better handover standards, flexible payment terms, and more transparent processes. Track record matters more than ever, and buyers are prioritizing developers with proven delivery capability and solid financial stability.

Below is a clear overview of the condo developments handing over in 2025–2026 and what they bring to the market.

Projects Handing Over In 2025–2026

To make this easier to understand, the projects are grouped by district.

BKK1 And Central Phnom Penh

Le Condé BKK1

Le Condé BKK1 – Luxury Smart Condo in Phnom Penh

- Developer: Wangfu International Real Estate Development Co., Ltd

- Location: BKK1, Phnom Penh

- Surrounding Landmarks: BKK Market, Independent Monument, AEON Mall 1, ministerial offices, embassies, Bassac Lane, Naga World, etc.

- Building Type: 43-story mixed-use luxury condominium

- Total Units: 1080

- Construction & Management: Built by top Chinese engineering firm; managed by Hopetree Japan

- Unit Types: Studio, 1-3 bedrooms, penthouse

- Floor Area: 64 m² – 879 m²

- Title: Strata Title

- Smart Features : Xiaomi Smart Home system (control lights, temperature, security)

- Amenities: Infinity pool, sky bar, Gym, yoga room, conference rooms, sky garden, jogging track, reading lounge, concierge & room service, ample parking

- Starting Price: $150,000

- Completion: May 2025

Time Square 306

Time Square 306 – modern luxury condo in Phnom Penh

- Developer: Megakim World Corp Ltd

- Location: BKK1, Phnom Penh

- Surrounding Landmarks: BKK Market, Independence Monument, AEON Mall 1, ministerial offices, embassies, Bassac Lane, Naga World, Olympic National Stadium, Riverside, Royal Palace etc.

- Building type: 45-story luxury condominium

- Total units: 350

- Unit types: 1-3 bedrooms

- Floor area: 41 m² to 135 m²

- Decoration style: Modern luxury condo

- Title: Strata Title

- Amenities: Lobby cafe, gym, kids’ play area, games rooms, infinity pool, garden deck

- Advantages: Prime BKK1 location, modern lifestyle amenities, flexible payment options, strong investment potential, competitive pricing

- Starting price: $93,000

- Completion: 2025

Chroy Changvar And Riverside Zone

La Vista One

La Vista One – Luxury Riverside Condo in Chroy Changvar, Phnom Penh

- Developer: Yin Yi Venture Co., Ltd

- Location: Chroy Changvar District , Phnom Penh – intersection of Mekong & Tonle Sap Rivers

- Surrounding Landmarks: Sokha Hotel, Norton University, Eden Garden, Toul Kork, Makro, N.3 Night Market, etc.

- Building Type: Twin-tower luxury condominium (41 floors, 140m tall)

- Total Units: 1,442

- Unit Types: Studio, 1–3 Bedrooms, penthouse

- Floor Area: 48 m² – 330 m²

- Decoration Style: Modern

- Title: Strata Title

- Greening Rate: 22%

- Amenities: Infinity pool, sky bar & restaurant, VIP lounge, sky garden, sauna, fitness center, concierge service

- Starting Price: $95,000

- Completion: 2025

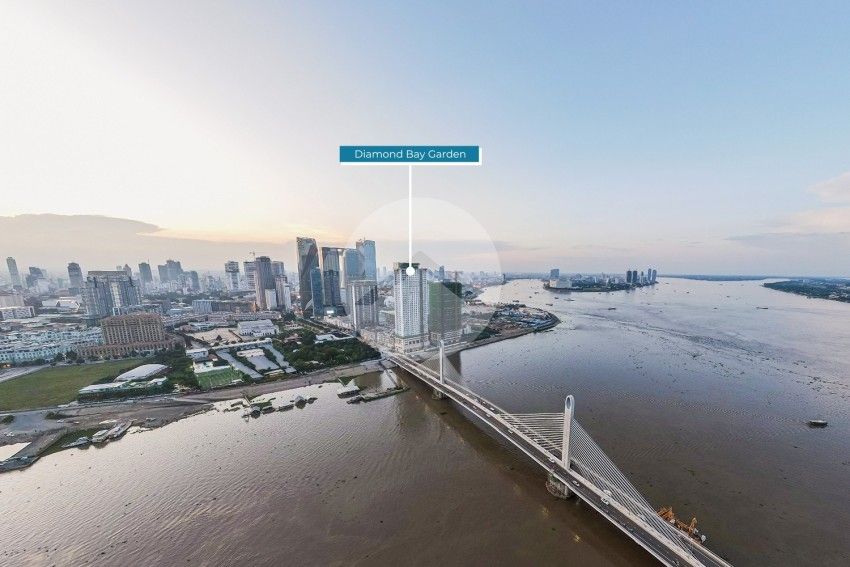

Diamond Bay Garden

Diamond Bay Garden Tower 1 – modern waterfront condo in Phnom Penh

- Developer: OCIC (One of Cambodia’s largest developers), Co-Managed by The Ascott Limited

- Location: Koh Pich area, Phnom Penh

- Building type: 39-story waterfront condominium

- Surrounding Landmarks: Diamond Island (Koh Pich), Norea Island, AEON Mall 1, Sofitel Hotel, major ministerial offices, embassies, international schools, etc.

- Total units: 591

- Unit types: Studio, 1-3 bedrooms

- Floor area: 60 m² to 170 m²

- Decoration style: Modern condo

- Title: Strata Title

- Amenities: swimming pool with Bassac River view, sky garden and sky bar, gym, yoga room, children’s playground, two parking floors with 1,378 lots, housekeeping services

- Community features: Located in emerging Koh Pich CBD with over 700 businesses, riverwalks, parks, F&B outlets, and entertainment venues nearby

- Advantages: Prime riverside location, modern waterfront living, strong rental demand and investment potential, easy access to city center

- Starting price: $132,000

- Completion: 2025

Vue Aston

Vue Aston – modern luxury riverside condo in Phnom Penh

- Developer: The Peninsula Capital Co., Ltd

- Location: Norea Island, Phnom Penh, along the riverside

- Surrounding Landmarks: Diamond Island (Koh Pich), Norea Island, AEON Mall 1, major ministerial offices, embassies, international schools, etc.

- Unique Advantage: Everlasting river view

- Building type: 38-story luxury condominium

- Total units: 895

- Unit types: Studio, 1-4 bedrooms, penthouse

- Floor area: 34 m² to 167 m²

- Decoration style: Modern luxury condo

- Title: Strata Title

- Construction area: 5,358 m²

- Amenities: Infinity pool, sky bar, gymnasium, sauna and spa, V-club, lobby areas, parking spaces, restaurants, convenience stores, concierge services, lounges, library, private cinema, housekeeping services

- Community features: Riverside location on emerging Norea Island, future bridge to downtown Phnom Penh improving accessibility, growing residential area

- Advantages: Modern design, extensive amenities, strong investment potential, guaranteed rental returns up to 35% over 5 years, flexible payment plans, attractive starting price, potential annual rental yield 5–9%

- Starting price: $133,000

- Completion: 2025

Hun Sen Boulevard And The Southern Growth Corridor

Urban Village Phase 2

Urban Village Phase 2 – modern mixed-use condo in Phnom Penh

- Developer: Goldfame Group

- Location: Hun Sen Boulevard, Mean Chey district, Phnom Penh

- Surrounding Landmarks: AEON Mall 3, Chip Mong 271 Mega Mall, 30 mins to Techo International Airport, etc.

- Building type: Two 51-story residential towers

- Total units: 1,700

- Unit types: Studio, 1-3 bedrooms, lofts, penthouse

- Floor area: 28 m² to 111 m²

- Decoration style: Modern

- Title: Strata Title

- Amenities: Swimming pool, fitness center, green parks, jogging and cycling paths, fine dining, advanced home tech systems, skyline and river views

- Community features: Award-winning master plan with landscaped open spaces and family-friendly living environment

- Advantages: Prime location along Hun Sen Boulevard, strong rental yield potential, high investment value, vibrant community with modern lifestyle conveniences

- Starting price: $70,000

- Completion: 2025

L Tower One (Boeng Tompun)

L Tower One – modern loft-style condo in Phnom Penh

- Developer: L Village Residence Co., Ltd

- Location: Boeng Tompun, Mean Chey District, Phnom Penh

- Surrounding Landmarks: Chip Mong 271 Mega Mall, AEON Mall 3, 30 mins to Techo International Airport, Russian Hospital, Russian Market, etc.

- Building type: Loft-style condominium

- Total units: 480

- Unit types: 1-2 bedrooms

- Floor area: 43 m² to 87 m²

- Land area: 1,800 m²

- Decoration style: Modern loft condo

- Title: Strata Title

- Floors / parking: Parking available 1st–6th floor

- Amenities: Modern loft design, city view, community-friendly spaces, fresh air and green surroundings

- Community features: Located on central “Golden Axis," close to Aeon 3, shopping, schools, and transport

- Advantages: Flexible payment (0 down payment), convenient location, modern lifestyle design, strong rental/investment potential

- Starting price: $52,000

- Completion: 2025

Toul Kork District

Royal Platinum Condominium

Royal Platinum – high-end mixed-use condo in Phnom Penh

- Developer: Royal Hong Lai Huat One Company Limited

- Location: Toul Kork district, Phnom Penh

- Surrounding Landmarks: TK Avenue, Eden Garden, View Park Mall, embassies, CamKo City, AEON Mall 2, etc.

- Building type: Two-tower high-end mixed-use condominium

- Total units: 851

- Unit types: Studio, 1-3 bedrooms, shophouse

- Floor area: 68 m² to 134 m²

- Decoration style: Modern mixed-use project

- Title: Strata Title

- Greening rate: 20%

- Floors: 30

- Amenities: Swimming pools, gym/fitness facilities, gardens, commercial spaces, concierge and property management services

- Community features: Central Toul Kork location with nearby schools, hospitals, restaurants, shops, malls, and excellent road connections to BKK1 and Sen Sok

- Advantages: Luxury residences, comprehensive amenities, strong rental investment potential, city views, modern design, convenient location within a highly urbanized district

- Starting price: $120,000

- Completion: 2025

Market Trends Reflected In 2025–2026 Handover Projects

Across all these developments, several themes stand out:

- Smart-home features are becoming standard

- Large amenity zones are now a core selling point

- Demand for hotel-style management is increasing

- Flexible developer payment plans continue to attract foreign buyers

- Hard-title registration is becoming more desirable

- Larger layouts are returning as expats prefer livable space over small units

These handovers also highlight a growing emphasis on build quality and practical living, moving beyond early-generation condos that relied heavily on speculation.

What Buyers Should Prioritize In This Cycle

With so many units coming online, selecting the right project matters. Buyers should consider:

- Developer track record and past handover quality

- Rental fundamentals in the chosen district

- Unit layout, natural light, and usable space

- Access to property management and services

- Payment flexibility

- Long-term exit planning with Capital Gains Tax coming into effect

A well-chosen project in the right location can outperform the general market even during high-supply periods.

Capital Gains Tax And Its Impact On Buyers

The Capital Gains Tax on Real Estate, effective January 2026, represents a major policy milestone shaping Cambodia’s property landscape. Investors must align strategies around compliant exit planning, shifting focus from short-term flips to sustainable, yield-driven portfolios.

Critical Regulatory Timeline: Capital Gains Tax (CGT) in Cambodia

| Asset Type | CGT Implementation Date | Tax Rate | Key Investment Impact |

| Securities, Leases, IP | September 1, 2025 | 20% flat rate on profit | Immediate tax consideration for non-immovable assets. |

| Immovable Property (Real Estate) | January 1, 2026 | 20% flat rate on profit (or 4% of sale price via lump sum) | Requires precise documentation and valuation for post-2025 asset sales. |

For 2025 buyers, the most important shift is the move toward long-term rental strategy rather than short-term gains.

Need Help Choosing The Right Condo?

The 2025–2026 handover wave introduces a wide mix of options, from riverside towers to community-focused developments. If you want updated pricing, rental projections, or help comparing these projects, the IPS Cambodia team can guide you based on real market data.

Contact us via Telegram or Live Webchat at the bottom left-hand corner or drop us a message through our contact page .

Related Articles

The True Cost of Ownership: What You Actually Pay for a Condo in Cambodia

So, you’ve been looking at the Cambodian skyline, maybe browsing through the latest high-rise developments in Phnom Penh or the boutique luxury builds in Siem Reap. You’ve seen the prices

Time Square 9 Gatsby Residence | Official BKK1 Launch & Pre-Booking

Explore BKK1 from every angle and see why The Gatsby Residence – Time Square 9 is the most anticipated address in Phnom Penh…

Time Square 5 is Now Complete, Pushing the Time Square Series into Its Next Chapter

The Momentum Continues: What’s Next in the Series With five completed projects and all 350 units in TS 5 officially sold out, the series is now pushing forward with four major developments across the capital and the coast. Time Square 6 (TS 302): Located on Street 302 in BKK1. It is a 48-storey tower that […]